Energy and the Irish electricity grid – a critical look towards 2030.

By Dr. Niall Burke – Bitcoin Network Ireland, Technological University of the Shannon, Ireland.

Description: This article breaks down the intricate interplay of energy, power dynamics, and the Irish electrical grid. While energy may be a conceptually abstract theory, this piece aims to demystify the complexities and establish a tangible connection between theoretical understanding and real-world implications. By bridging this knowledge gap, readers will hopefully gain valuable insights into the practical applications of energy concepts. Furthermore, the article offers a detailed examination of the current state of the Irish electrical grid infrastructure, shedding light on its key components and operational mechanisms. As the energy landscape evolves, the narrative extends to explore the strategic developments and transformative initiatives shaping the trajectory of the Irish grid, with a particular focus on the envisioned advancements leading up to 2030 and beyond. This exploration not only provides a snapshot of the present but also offers a forward-looking perspective, offering readers a nuanced understanding of the challenges and opportunities that lie ahead in the realm of energy and electrical power within the Irish context.

Download a PDF copy of this report here.

Table of Contents

- Introduction: Energy

- Energy Consumption

- What exactly is work?

- Electric Grid: Energy Demand

- Electric Grid Operation – 4 key components

- Power Generation

- Power Generation – Economics

- Grid Interconnection

- Energy Storage

- Demand Response

- Grid Operation – Summary

- Bibliography

Introduction: Energy

A good starting point in this article is to acknowledge energy cannot be created nor destroyed, just changed from one form to another, which is good news as we can never destroy energy! The other good news is that energy is abundant and freely available, and its utilisation is directly related to our quality of life.

Generalising, we take for granted how energy consumption, life, wealth, and standards of living are inextricably linked. Ultimately, there is no route to economic development without greater energy consumption (Jack, 2022). This is counterintuitive to a recent culture and narrative that has grown in its belief that any energy use contributes to climate change, and a millennial guilt of growing influence is enacting legislation to reflect that belief. Writing energy efficiency measures into law, regardless of the source of energy, is a prime example (DoECC, 2022). Legislating for an outright reduction in energy demands, regardless of the source, is another example where the European Commission’s Energy Efficiency Directive, which came into force in October 2023, requires all Member States to reduce their Final Energy Consumption (FEC) demand to a “specified figure” by 2030 (European Commission, 2021). For Ireland the figure is 12.6% less than the 2022 total energy consumption (Lehane, 2024). It is worth bearing in mind that nuclear power is illegal in Ireland, and thus it’s excluded from all energy policy discussion (Wilson, 2023). A fundamental misalignment like this as a starting point when developing a transition in national policy goals has a very real possibility of drifting Ireland towards illogical conclusions, thus becoming unreasonable and ultimately unworkable.

To get a better understanding of what is going on, and what’s at stake, energy itself needs to be defined and contextualised. Energy is scientifically measured in “Joules” [J], or Mega-Joules [MJ], etc., and power is simply a flow of energy over time, and most understood as energy [J] moving every second [s]. This Joules per second [J/s] flow of energy is more commonly known as the “Watt” [W]. We intuitively understand this relationship when we refer to human endeavours as requiring “time and energy”.

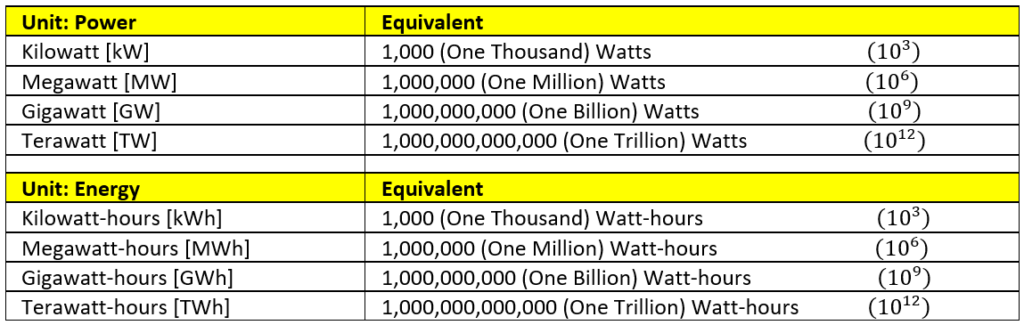

Instead of Joules however, industry measures energy in kilo-Watt-hours [kWh], Mega-Watt-hours [MWh], Giga-Watt-hours [GWh], or Terra-Watt-hours [TWh]. A “kWh” is the “unit” of electricity seen on electricity bills.

Table 1: Power & Energy Units

The simplest way to explain the link between power in kilo-Watts [kW] and energy in kilo-Watt-hours [kWh] is to multiply the amount of power [kW] by the amount of time in hours [h] that power is being produced or consumed. For example, a 1 [kW] kettle boiling for 1 hour [h] will consume 1 [kWh] (i.e. 1 [kW] x 1 [h] = 1 [kWh]).

Energy Consumption

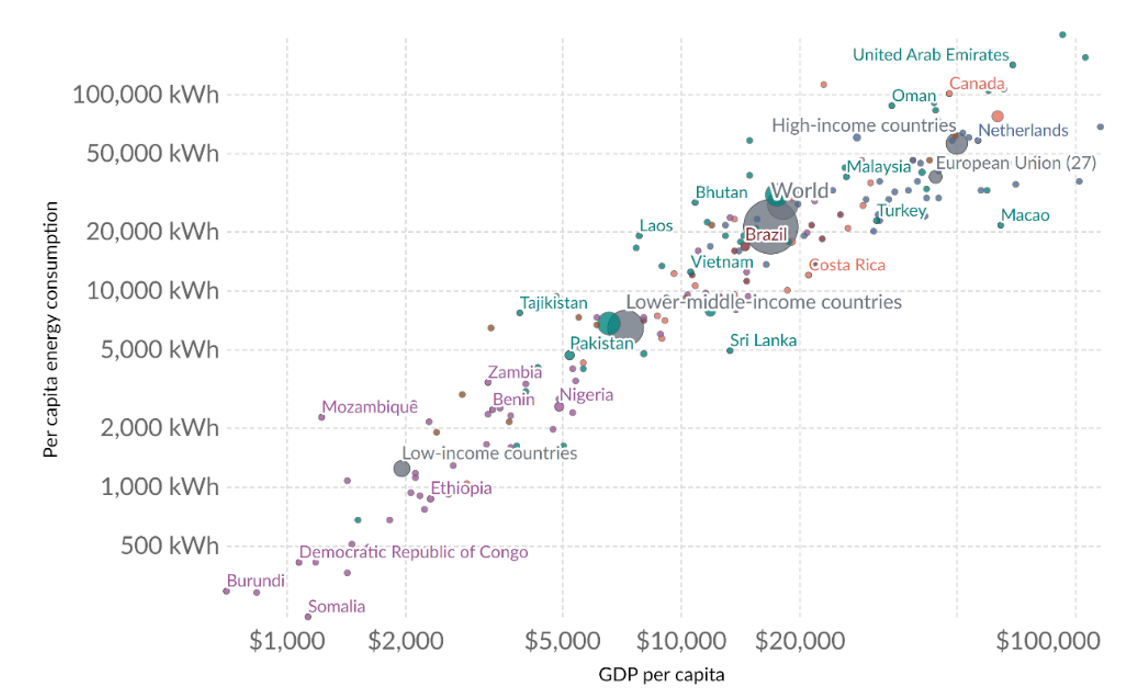

In adults Calories are food energy, and a typical adult consumes a range anywhere from 1,800 and 2,800 Calories (or kilo-calories) per day. Per person, that translates to between 2 and 3.3 [kWh/day] or between 800 and 1,200 [kWh/a] over a year. Not considering takeouts, grocery costs per person are currently around €2,289 per year (BNI, 2024) (Healy, 2022) (CSO, 2023) (Bray, 2019) and this equates to an average cost of around €2.34 per kWh, which is expensive energy! As a personal energy requirement, this represents food energy alone and does not include all the other energy requirements such as heating/cooling, electrical, transport, products, and services. Estimates of the total energy used per person throughout the world is shown in Figure 1.

For Ireland in 2022, the energy use per person was 37,761 [kWh/a], and food energy represents between only 2 and 3% of this total energy consumption.

Typical heating for a family home is around 11,000 [kWh/a] and divided equally amongst a household representing 2.7 people (CSO, 2023) then the heating energy consumption per person is around 4,000 [kWh/a], or around 11% of a person’s annual energy consumption.

Food and shelter represent around 12% of the total energy consumption, and therefore 88% of the total energy is for additional needs like goods, services, and transport. Think of how harnessing energy sources for our needs (other than physiological) represents the equivalent of 9 people working directly for you, for negligible pay!

General per person electric consumption in Ireland is around 6,689 [kWh/a] (ourworldindata.org, 2024). However, this number is very much skewed by the fact we have a substantial electrical use in industries here. With official electricity consumption per dwelling in Ireland being 5,040 [kWh/a] (SEAI, 2022), the per person consumption rate is around 1,846 [kWh/a] domestically.

Figure 1: Energy use per person 2022 (ourworldindata.org, 2024)

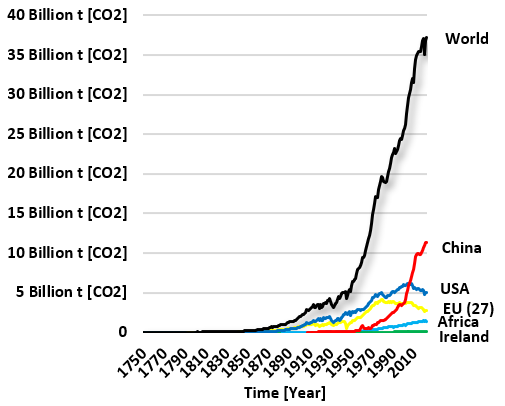

What also needs to be understood is the overall trend in both absolute energy consumption worldwide and emissions, as per Figure 2 below.

|

|

|---|

Figure 2: (a) Annual energy consumption per country/region & (b) emissions per country/region (ourworldindata.org, 2024)

What is worth taking away from the data in Figure 2(a) is whilst the world currently consumes around 170,000 [TWh/a] of primary energy, the sun delivers around 150,000,000 [TWh/a] of solar energy to the earth, therefore the world is currently consuming the equivalent of 0.1% of incoming solar energy, which is obviously negligible.

Whilst there is generally an ongoing shift from fossil-fuel to renewable energy-based supply in the developed world, there is however very little evidence of substance showing a decoupling of the strong link between energy consumption and standards of living, particularly in low to middle income economies (Wu et al., 2022).

Indeed, due to this relationship there is a very durable correlation between the value of legal tender, the economy, and energy, as seen from Figure 3 below, where the more energy is consumed, the stronger the economy.

Figure 3: Energy use per person vs. GDP per capita, 2021 (ourworldindata.org, 2024)

There is however some evidence of higher income economies breaking the link between energy consumption (both through energy reduction and shift to renewables) and maintaining standards of living (Richie, 2021), however the longer-term implications of this are still to be fully observed. Thus, what needs to be borne in mind is that there will inevitably be a real cost of moving to renewable energy that will be absorbed by a reduction in disposable income, but the hope is that it will occur without having a dramatic effect on standards of living.

In terms of energy having value, human interaction in the process is important as we give energy direction, and utility. Energy generally requires some effort to make it useful, which entails the input requirements of time, energy, and technology. Yes, energy is required to move or change energy!

Energy not only has a quantity as stated, but it also has a quality, as there is useful energy and waste/unusable energy. We generally need energy in the form of chemical (food!), light, heat, and movement, with all chemical, light & movement energy, and all ultimately become heat, and entropically no longer available or usable. The quantity of unusable energy is constantly increasing in the universe over time – it’s what gives time direction, but it happens so slowly we don’t even notice it. It’s like throwing a cup of hot water into the ocean; it does heat the ocean, but its change is imperceptible.

Thermodynamic entropy is what we call this unavailable energy, or more fundamentally, energy that has become low grade heat and can no longer be used to perform “work”. Therefore, at the very heart of “energy” is the specific definition of its ability to do useful “work”.

What exactly is work?

Work is essentially the forced movement of a physical mass and is expressed as force multiplied by distance (W[J]=F[N]×d[m]). For humans this work is implies a physical exertion or simply moving. For example, picture flexing your arm from one position to another: this is a physical movement of mass (your arm) with force and is thus a “work” energy.

The amount of work done here is measured in “Joules” [J], as an energy, and if you recall from earlier if this work is done every second, it becomes power. Imagine “working out” in a gym and you flex your arm once per second – that’s power you’re producing. Now put a weight in your hand – adding mass will add to the power required to flex!

When work is generated by converting kinetic (moving) energies into smooth rotating mechanical energy it is subsequently then fed into a generator to become electricity, or it can instantly become electricity in the case of solar PhotoVoltaic (PV) systems, without having to start as kinetic energy.

So, energy is work, and work conducted over time is power, and this power is money when it is measured on the electric grid.

Electric Grid: Energy Demand

Electricity is the flow of electrons, and are generated through the photovoltaic effect, a fuel cell, or via an electric motor. These energy converters are fuelled by radiant energy (solar photovoltaics), chemical energy (fuel cells), nuclear, and thermal energy conversion into mechanical kinetic energy (spinning steam & gas turbines, wind turbines, hydro turbines, etc..) that is then fed as a rotating shaft into an electric motor. Once produced, the electricity is conditioned for voltage and frequency and fed either into local applications, or out onto the national electric grid.

The grid of the island of Ireland is controlled by EirGrid in the south and SONI in Northern Ireland and are referred to as the Transmission System Operators (TSOs) and is made up of a network of infrastructure including power generation, transmission, distribution, and metering. The electric grid transmission is a mesh of various capacity power lines that traverse the country, traditionally delivering power from central source (power stations) to homes and businesses right out to the extremities. However, due to the growth of renewable generation, modern grids are now required to facilitate delivery of power from the extremities back into the large demands in urban centres.

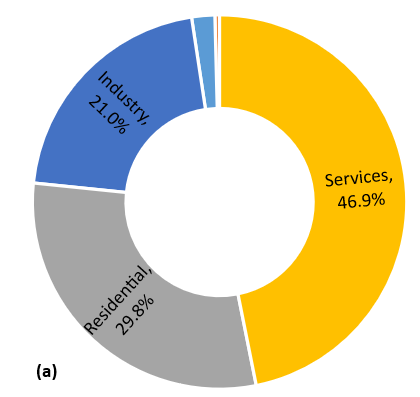

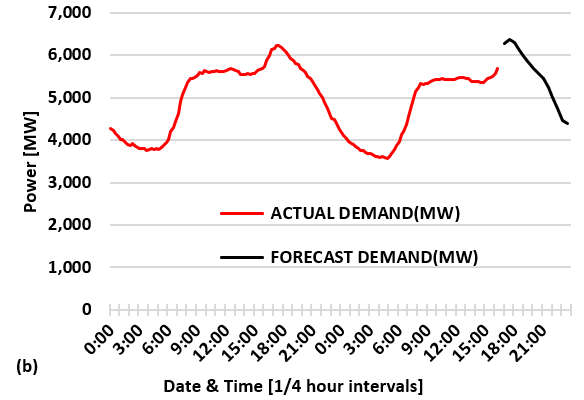

The current demand on the Irish grid generally fluctuates roughly between 2,500 and 7,000 [MW] and can be broken down into residential, commercial services and industrial energy demands, as per Figure 4(a) below, which can be seen as a typical winter demand aggregate in Figure 4(b).

|

|

|---|

Figure 4: (a) Irish grid demands by sector 2022 (SEAI, 2022) (b) All-Island Grid Demand 20th & 21st of Dec 2023

The overall amount of energy being demanded via the electric grid is set to grow substantially in the future as more modes of energy demand move, as predicted, to electric (EirGrid, 2024).

There are several future demands for energy that are expected to put pressure on the Irish electrical grid:

- Electric Vehicles (EVs): As more people switch to electric cars, the demand for electricity to power these vehicles will increase. This could lead to challenges for the electrical grid, especially during peak charging times.

- Heat pumps: Heat pumps are becoming increasingly popular to heat (and cool) homes and buildings. These devices use electricity to extract heat from the air or ground and distribute it throughout a building. The increased use of heat pumps will lead to higher demand for electricity during the winter months, which could put pressure on the electrical grid.

- Data centres: Ireland is home to many large data centres, which consumed 601 [MW] of electrical power in 2022 which represents 18% of demand (Collins, 2023), and is envisaged to grow to between 819 and 1611 [MW], between 25-30% of electricity demand, by 2030 (EirGrid, 2024). Whist the average data centre electrical consumption worldwide is around 1% of demand, Ireland’s climate is ideal for the efficient running of data centres, hence why they are disproportionately targeting Ireland for installation. As the demand for digital services continues to grow, and with the rapid advancement of artificial intelligence chatbots, the demand for electricity to power these data centres is also likely to increase too. Indeed Artificial Intelligence (AI) interface is a major growth area for computational power demand, and indications are the power consumption in this area is set to exponentially increase over the coming years (Mims, 2023), with suggestions that worldwide AI systems will need 100 [GW] of power by 2026 and 1000 [GW] by 2027 (Wang, 2024).

What is observable from the electrical demand data is that there is a notable relationship between ambient air temperature and electrical power demand on the grid, particularly in residential and services, where for every 1° drop in temperature in the winter an additional 40 [MW] of power demand is put onto the grid (EirGrid, 2024). This relationship will be further exacerbated over the coming years when more electric driven heat pump heating systems goes onto the grid, as building heating moves further away from oil and gas supply.

Whilst the drivers for all the future additional electrical demands are understood, it must however be noted that this mass electrification strategy is not wholeheartedly embraced by the private energy industry (Mulligan, 2023).

To address growing challenges that this strategy will face, Ireland inc. requires substantial investment in upgrading and modernising its electrical grid infrastructure, including the development of smart grid technologies that can manage and optimize energy flows. Additionally, efficient use of energy measures and demand response programs can help manage overall energy demands alleviating pressure on the electric grid.

Electric Grid Operation – 4 key components

To understand the ways in which we can address future grid stability and security issues we need to understand how a national grid is kept operational, and this is achieved by four means: flexible generation, inter-grid transmission (international), energy storage (batteries, pumped hydro, etc.), and demand-side response (or “Demand Response (DR)” or “Demand Side Management (DSM)” (Carter et al., 2023).

Power Generation

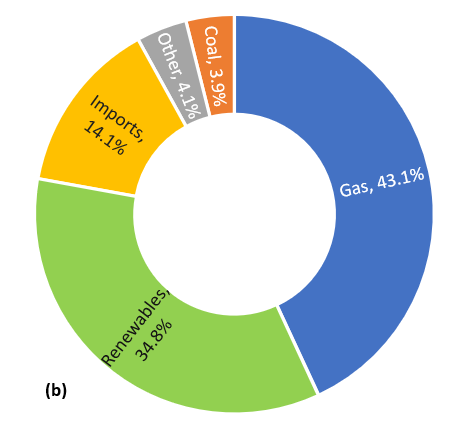

In absolute energy terms, Ireland is 80% reliant on imported fossil fuels, 20% of which is consumed on the national electrical grid (SEAI, 2023). From a national perspective, renewables are seen as sustainable, but also an indigenous energy supply, which enable some security of supply and movement away from import dependence. While renewable energy sources such as wind, hydro, solar and biomass are essential to achieving Ireland’s climate targets, they also create substantial challenges for the electrical grid as it grows beyond the 35% energy supply currently generated (Figure 5).

|

|

|---|

Figure 5: (a) Grid energy annual supply 2021, (b) Grid energy supply October 2023 (EirGrid, 2023)

As outlined by the Irish government, the electric grid is projected to provide 80% renewable energy generation by 2030 (DoECC, 2023). The Irish government, along with 110 other countries, pledged to triple the world’s renewable energy by 2030 at the U.N.’s COP28 climate summit (Abnett et al., 2023). To facilitate this commitment the government of Ireland is targeting the delivery of at least 22 [MW] of renewable power (DoECC, 2023), whilst also maintaining grid security and stability.

Electric power generation is categorised as either being from synchronous, dispatchable supplies (baseload steam power-plants & hydro) or from non-synchronous, non-dispatchable supplies like wind and solar photovoltaic (PV). Synchronous generation systems can match the grid’s frequency of 50[Hz], which is a product of the rotating shaft speed, and dispatchable generation systems can be called upon to supply rapidly, either instantly or within a few minutes, and deactivated when required. This flexibility allows grid operators to dispatch or control the generation of electricity from these sources based on factors such as demand fluctuations, grid stability, and economic considerations.

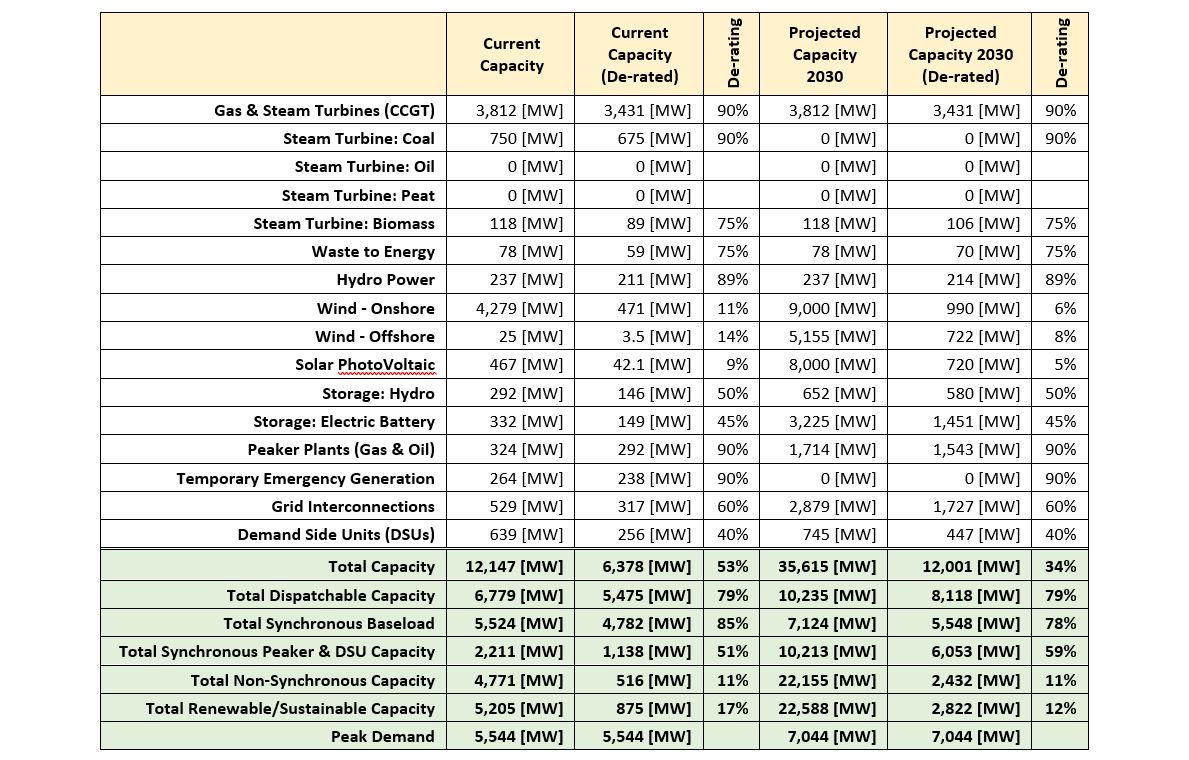

While difficult to determine the exact figures, what can be observed from all the publicly available reports from the Irish government and their State bodies tasked with implementing the plan is an outline of supply capacities for the transition, as shown in Table 2 below. Going by the government projections for 2030, renewables will make up 63% of the total rated capacity (up from 41% currently), and 220% of the total dispatchable capacity (up from 71%). Take note of the differentiation of the two grid jurisdictions under EirGrid and SONI, with this report primarily covering the republic of Ireland with some reference to the All-Island system.

Table 2: Republic of Ireland Electric Grid Power Capacity, now and projected 2030

From the above, what needs to be stated is that there is a difference between the maximum rated capacities and their supply dynamics between the different forms of electrical generation plants. A “de-rating” factor is applied to all modes of power generation, and it indicates the reduced level of electricity production compared to its full capacity, typically expressed as a percentage. This de-rating is influenced by factors like high temperatures, altitude, humidity, fuel quality, partial loads, maintenance (planned and unplanned), environmental regulations, grid limitations, aging equipment, and economic considerations such as fuel availability and prices (SEMO, 2019).

For renewable energy generation, factors like intermittent energy sources, weather conditions affecting output, and technological constraints contribute to de-rating. Non-synchronous generation can have de-rating factors of between 1% and 15%, while synchronous dispatchable generation systems generally have higher de-rating factors of between 50% and 90%. Therefore, for example, to enable 1 [MW] of grid capacity, between 1 [MW] and 2 [MW] of dispatchable/synchronous generation capacity, or between 7 [MW] and 100 [MW] of non-dispatchable/non-synchronous renewable generation capacity is required.

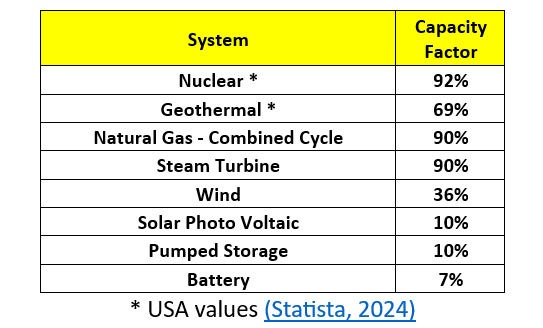

The basic economics of power generation is dictated by a combination of a simple cost per MW of installed capacity, the de-rated capacity, the capacity factor, and the cost of the raw energy (fuel) being converted into electricity.

A capacity factor is not to be confused with the de-rating factor in that a capacity factor is a measure of the actual output of a power plant over a specific time-period compared to its maximum rated output if it operated at full capacity continuously. Whilst baseload steam & gas turbine power stations can have capacity factors of 65% up to 90%, renewables like wind and photovoltaic can have capacity factors of between 30-35% and 10-15% respectively. Incidentally, nuclear has the highest capacity factor at around 92% (Statista, 2024). Due to a combination of both de-rated capacity and capacity factors, non-synchronous renewable power generation needs to be built in multiples of capacity in comparison to demand to ensure grid security and stability.

Table 3: Typical Capacity Factors

Whilst biomass and hydro plants are generally solid baseload dispatchable systems, wind and solar renewable sources are highly variable in supply, which means that the electrical grid must be able to adapt to these natural supply fluctuations and mismatches with demand. This is a relatively new phenomenon to the Irish grid, which historically had very stable dispatchable baseloads to call upon when required.

Therefore, on a highly non-synchronous grid, flexible generation is explicitly required and involves multiple dynamic systems that can ultimately be relied upon to maintain a stable baseload, being the electricity generator of last resort. These dispatchable systems typically are the marginal generators, setting the spot price of electricity, which means they turn off if the price of wholesale electricity goes too low, activating again when the price rises past a profitability threshold based on the price of the input fuel being consumed.

The only baseload steam turbine plant in Ireland utilising biomass currently supplies 118 [MW] of dispatchable power to the grid via Bord na Mona’s Edenderry powerplant, which was recently fully converted to biomass from peat, with planning permission granted for continuous use up until 2030. This is a baseload fully dispatchable plant, ideal for maintaining solid grid stability. What happens to this facility after 2030 is uncertain.

Seen as quasi-renewable, Waste-to-Energy currently delivers 79 [MW] of power in Ireland and is also viewed as a valuable baseload dispatchable supply to the grid. Whilst Waste-to-Energy is governmentally seen as part of a sustainable transition there is little in the way of official specific detailed for growth in this area up to 2030 (SEAI, 2018) (SEAI, 2023). Indeed Indaver, one of Ireland’s current Waste-to-Energy providers (17 [MW]), is seeking to generate hydrogen from any surplus capacity it may have in the future up to 10 [MW] (Joyce-O’Caollai, 2022), with no indication of any further expansion into Waste-to-Energy.

The plan to decommission Ireland’s only remaining 750 [MW] coal power plant in Moneypoint November 2024 while Ireland’s only 592 [MW] oil power plant in Tarbert was due to close at the end of 2023. The Tarbert facility is planning to transition to Hydrotreated Vegetable Oil (HVO) as a 350 [MW] Open Cycle Gas Turbine (OCGT) becoming operational by 2026/2027, with the potential to utilise hydrogen as a fuel in the future (SSE, 2024).

30% of the current thermal baseload is over 30 years old and their ability to remain in service beyond 2030 is a question that has no definitive answer (EirGrid, 2023). However, this may be moot as the Irish government’s sustainable transition plan seeks to fully phase out the current 4,800 [MW] natural gas (CCGT), coal and oil baseload by 2035 (EirGrid, 2023), with the plan being to replace that dispatchable capacity with “peaker plants”, multi-hour electric storage, and grid interconnectors to the UK and France (see next section).

Peaker plants are an ancillary service that provides power generation facilities, generally natural gas fuelled turbines, that are used to supply electricity whenever the demand exceeds the baseload and non-synchronous supply as a way of adding capacity to get over any “peak” in demand. Ancillary services like this are required where grids undergo high and rapid degrees of imbalance between supply and demand, like where there is an unscheduled power system event that needs time to recover. Routine peaks in demand occur in the morning and in the evening (see Figure 5(b)). These Peaker plants utilise natural gas but generally have efficiencies between 30% and 42%, which is much lower than that provided by current baseload natural gas Combined Cycle Gas Turbines (CCGT) which have efficiencies of around 60% to 65%. They are contracted based on the electricity they supply and the standby capacity they can deliver when needed. The costs involved are around €1.25 million per [MW] capacity (Bord Gáis, 2023).

Due to universal thermodynamic principles, there are limitations to the conversion of fuels via thermal engines into electricity. As stated, the CCGT is amongst the best giving around 60% thermal efficiency, with the remaining 40% being “waste heat”. This waste heat generally has a temperature of around and is typically dumped into a river or the air via a cooling tower, generally giving an imperceptible rise in the river/air’s temperature. At this waste heat is not very useable or indeed valuable. Some countries do use this waste heat in district heating schemes but need to bring up the “waste heat” temperature from to to make it usable. However, this has the knock-on effect of bringing down the turbine’s thermal efficiency and thus reducing the electrical power output of the turbine. In utilising this otherwise waste heat, Ireland has recently introduced its first public district heating scheme in Tallaght (O’Connell, 2023).

The Irish government has plans to increase Peaker capacity into the future to function periodically as a grid stabilisation measure when non-synchronous supply is low, as stated previously. However, the scale of non-synchronous generation proposed for the grid has never been done before and so there is heightened risk and uncertainty that the grid will come to over-rely on these Peaker systems if the grid becomes too unstable, constantly.

At maximum capacity, the republic of Ireland currently has an estimated 6,779 [MW] dispatchable plant including grid interconnection, Demand Side Units (DSUs) and Aggregated Generator Units (AGUs), but excluded small scale generation or renewables (Soni, 2022).

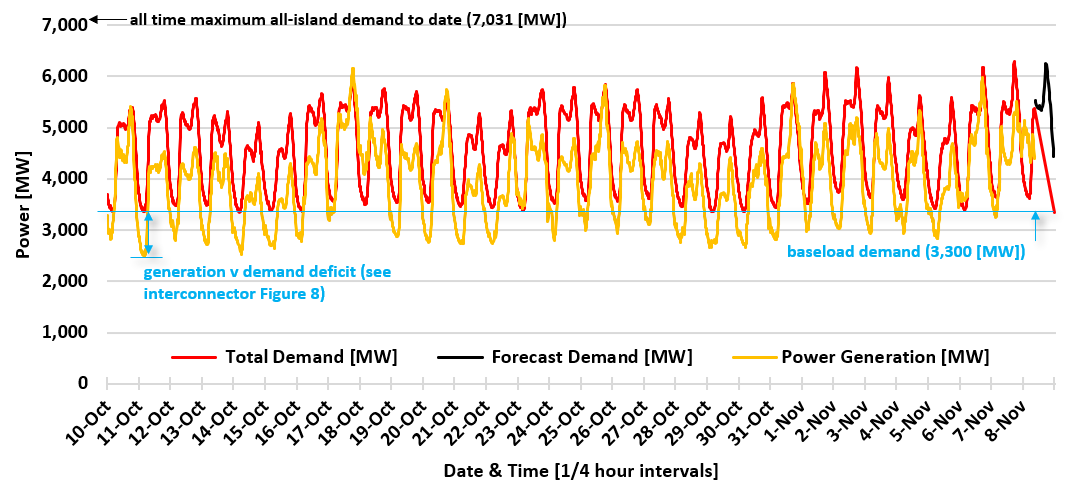

However, the republic of Ireland currently has a de-rated dispatchable capacity of 5,475 [MW]. If this 5,475 [MW] is compared to the highest demand recorded of 5,544 [MW] (7,031 [MW] all-Island) (see Figure 6), then it is easy to see a prolonged period of low or no wind in the winter could leave the grid very vulnerable to blackouts, particularly in the event of a large baseload going offline unexpectedly.

Figure 6: Month’s All-Island electricity supply and demand, with baseload and peak load indicated.

The projections for 2030 indicate a de-rated dispatchable capacity of 8,118 [MW], which compared to a modest projected additional demand of 1,500 [MW] by 2030, giving a potential peak demand of over 7,000 [MW]. This would indicate a better degree of adequacy, assuming all the projections go to plan where all the assumed extra generation comes online, and no older existing generation plants go down unexpectedly early. This does not take into account a boom in AI computational requirements in Ireland.

Reliability standards in the European electricity sector, determined by the ‘value of lost load’ and the cost of new infrastructure, vary across countries. While the EU average is three hours, Ireland’s standard is eight hours, suggesting a divergence in reliability standards. EirGrid carry out their own reliability adequacy assessments, where they calculate a Loss of Load Expectation (LOLE), indicates the expected number of hours in a year during which electricity generation may be insufficient to meet the total demand. Ireland’s 2022 LOLE was 52 hours, reflecting a significant capacity shortfall. Consequently, public declarations regarding grid reliability have ensued from this development.

“EirGrid warns of possible 1,050 [MW] energy shortfall by 2025 due to rising demand” (O’Halloran, 2021).

Concern conveyed by EirGrid, a key decision maker, with regards to the implementation of the governments energy policy by the Commission for Regulation of Utilities (CRU) is never a good sign, and from a public’s perspective, policy diplomacy delivered through the media does not instil confidence. Furthermore, from Eirgrid’s Generation Capacity Statement (EirGrid, 2024) they see the LOLE rising to a worrying 303 hours in 2025 before coming back down to 15 over subsequent years with grid interconnection capacity growth.

Due to this heightened level of grid uncertainty the Irish government enacted a “Temporary Emergency Generation” legislation in 2022 that provided funding for 4 emergency gas turbines (Shannonbridge 264 [MW], Tarbert 190 [MW], North Wall 200 [MW] and Huntstown 50 [MW]) having a combined 650 [MW] capacity (Development (Emergency Electricity Generation) Act, 2022), with Shannonbridge’s 264 [MW] being the only one in operation to date. However, under legislation they are also due to close operation again in March 2027. The assumption for the temporary nature of this measure is that there will be new dedicated gas Peaker plants coming online in 2027 to alleviate the supply deficit. Any contractual drop-off from the 2027 auction results would nonetheless be concerning for future grid stability. Bord na Mona recently applied for planning permission for a 710 [MW] CCGT power plant in the midlands that will utilise the natural gas grid, with the view to it moving to hydrogen in the future. This would offer a substantial increase in de-rated dispatchable baseload and alleviate a lot of security concern, assuming it goes ahead (Carey, 2024).

The Irish government’s hope is to alleviate all concerns articulated to date by ensuring renewable dispatchable generation will be utilised to maintain system reliability, where they mention (but don’t reference) a recent report from the IEA estimating that “approximately 5-15% of electricity needs will come from zero carbon dispatchable generation in a sustainable and secure power system” (DoECC, 2023). Following on from this 2021 capacity crisis the CRU stepped up its effort to mitigate the risks of failure by developing a security of supply programme, primarily based on the temporary retention of the only coal fired power station in Ireland at Moneypoint (CRU, 2023). However, the Winter Outlook 2023/24 Report indicated some improvement, with a reduced LOLE of 21 hours compared to the previous year, but still inadequate by international standards. This has now developed into a persistent feature of the grid with no guarantee it will be alleviated in the future by the CRU measures outlined.

Power Generation – Economics

Currently, about 40% of the world’s energy consumption comes from crude oil, and that makes it the most “liquid” tradable energy in the world, predominantly priced in US dollars per barrel of White Texan Intermediate (WTI). WTI currently trades at a value of around $80 per barrel, which translates into 4.3 cent (euro) per kWh. Due to the unavoidable thermodynamic efficiency of oil based thermal power plants being around 40% then the natural base price of electricity would be 10, and thus all prices above reflect a combination of expensive alternative energies & conversion technologies, restrictive market practices, market frictions, taxes, and investment returns.

Wind and solar power generation investment costs are predominantly all up front, with the energy supply (wind & solar) being essentially free. However, due to having no control over the supply, wind and solar electricity producers are “price takers” and cannot set the price of electricity at the margin which “price makers” do. Price makers are typically baseload synchronous dispatchable suppliers (coal, oil, and natural gas power plants) who can turn off their electricity generation when electricity prices go too low in comparison to their fuel input costs, thus saving themselves from running at a loss. While there’s limits to this system’s ability to scale up and down supply, generally it’s a straightforward pricing model.

As wind and solar cannot set spot wholesale prices as a price taker, for them to de-risk the substantial upfront investment the government needs guarantee a minimum wholesale electricity price to them. Bear in mind the capacity requirement for non-synchronous supply is multiples that of a synchronous supply, where the installed capacity cost is estimated for CCGT to be around €1 million per MW, €1.4 million per MW for on-shore wind and €1.5 million per MW for solar (Waldon, 2022).

This de-risking is usually formalised over an extended period (with inflation adjustments) through a Contract for Difference (CfD) – if the price of electricity gets higher than the agreed (strike) price the wind producers pay the difference to the government, and vice versa.

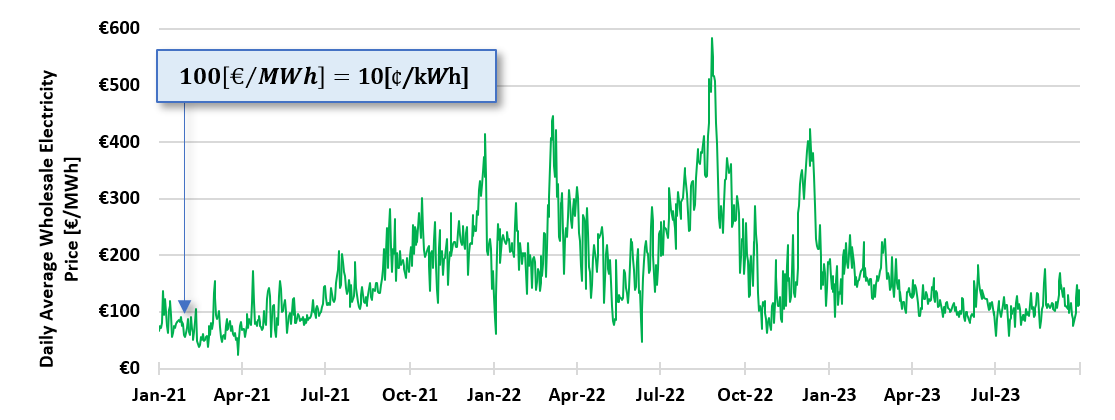

The trend here is important, the progressive move from a fully synchronous and dispatchable grid supply to one that is developing into a highly asynchronous and non-dispatchable one. This is inevitably going to lead to substantial fluctuation in wholesale electricity prices. While the prices shown in Figure 7 are wholesale, it generally translates to retail prices with a percentage margin markup. For reference, 100 [€/MWh] equates to 10 cent per kWh. The current retail market rate for electricity is around 30 [¢⁄kWh], putting 20 [¢⁄kWh] on top of a 10 [¢⁄kWh] wholesale price.

Figure 7: Wholesale electricity prices in [€/MWh] (SEMOPX, 2023)

The large swings in electricity prices in Figure 7 reflects a weakening of indigenous baseload electricity supply versus demand, as illustrated in Figure 6.

The retail electricity cost per kWh is made up of the wholesale price as shown above, transmission transfer and service charges of around 2 [¢⁄kWh], distribution charge of between 3 and 5 [¢⁄kWh] (paid to ESB Networks), the retail provider’s margin/markup, along with 9% VAT (~3[¢⁄kWh]) which is due to go back up to 13.5% in October 2024.

The State currently guarantees a base payment of €100.47 per MWh (¢10 per kWh) under the Renewable Energy Support Scheme (RESS 3) and thus there continues to be a wind capacity investment appetite (EirGrid Group, 2023). What this effectively means is that windfarms can technically sell electricity at a wholesale price down to minus €100.47 per MWh and remain profitable (assuming they have not been called to Dispatch Down/turn-off by the Grid Operator). Indeed, the appetite for investment remains strong with four offshore wind farms totalling 3,074 [MW] capacity currently in the development stage settling at an auction price of €86.05 per MWh (8.6 ).

As Ireland moves further into non-synchronous renewable supply as a percentage of demand the fluctuations in prices will potentially at times go higher again and even go negative, as happens in other grid jurisdictions like mainland Europe where in 2023 there were 1,043 hours of negative prices due to high wind and solar penetration and low demand (Morison, 2023) (Gkousarov, 2023), (European Commission, 2023) and with similar instances on the Texas grid in the USA (ERCOT, 2022). Indeed, those in the industry strongly suggest that the latest iteration of the Renewable Energy Support Scheme (RESS 4) will remove guaranteed payments going forward for new capacity, potentially leading to substantial periods of time where electricity on the grid is negatively priced.

Without overstating it, large fluctuations in electricity price is obviously not an ideal model under which to base a modern electrical dependent economy, with significant fluctuations in wholesale electricity prices inevitably resulting in overall higher electricity prices for retail consumers. Given that the price of electricity is factored into almost every good or service produced or sold in Ireland, the foundational economic importance of this cannot be overstated.

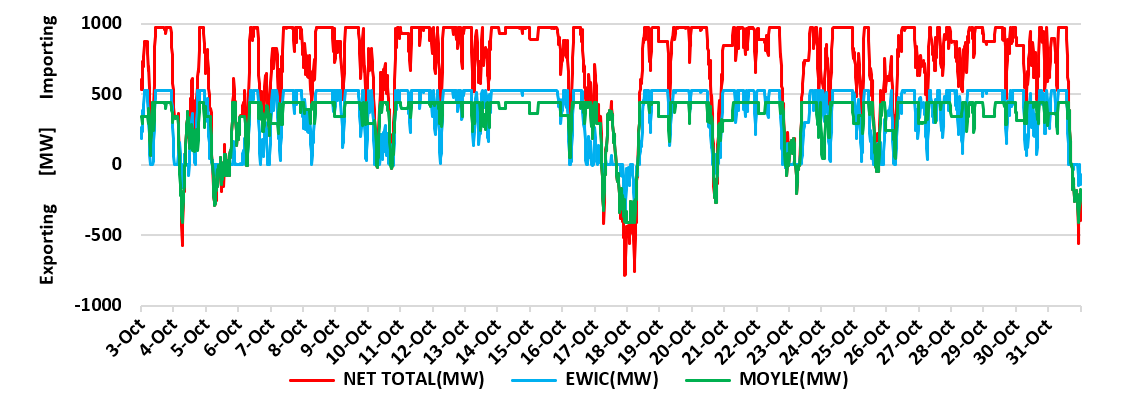

Therefore, when demand is high, but supply is low, and there are no more synchronous dispatchable supplies to call on, power supply from across international waters is called upon, as can be seen in Figure 8.

Grid Interconnection

Ireland has two High Voltage Direct Current (HVDC) grid interconnectors with Northern Ireland’s SONI connecting to Scotland (450 [MW]- Moyles) and EirGrid connecting Wales (529 [MW] – EWIC), along with another one currently under construction to France (700 [MW] – Celtic Interconnector, due to be operational by end of 2026). There is also a 500 [MW] “Greenlink” private interconnectors between Wexford and Pembrokeshire (Wales) due to become operational by the end of 2024. A further 700 [MW] interconnector to France is currently in the early proposal stage.

Figure 8: All-Island Grid Interconnection October 2023 (EirGrid Dashboard, 2023)

Within Ireland there is a 400 [MW] North-South interconnector linking the two independent grid regions of the island of Ireland and will help overall grid security and stability, notwithstanding substantial local objections, and is proposed to be operational by 2026.

What is noticeable from the chart above is the disproportionate amount of power import, which is indicative of a native system under supply stress. This stress on the generation side can be somewhat alleviated with the use of “Peaker” power generation plants and “Temporary Emergency Generators” which are supposed to be used sparingly as a baseload flexible supply, but only when the grid is under unforeseen pressure – they are not supposed to be providing baseload on a perpetual basis as they have very low efficiencies. Add to this dilemma the fact that the Moneypoint 750 [MW] coal powered system is due to close in November 2024, which represents nearly 14% of Ireland’s de-rated generation, or 14% of Ireland’s maximum electrical demand (to date) of 5,544 [MW].

In terms of value to the grid, the de-rated capacity of grid interconnections is typically valued between 45% and 54%.

The fact that our all-island capacity supply is more than 1,000 [MW] below our peak demand, consistently, is a potential grid network stability red flag. However, there are also market forces at work where UK power producers get a higher remuneration by providing electrical power to the Irish grids rather than selling to their own domestic one.

Energy Storage

Energy that is constantly moving like electricity is called kinetic energy. Kinetic energy is generally difficult (and thus expensive) to store and has to date been primarily stored through pumped hydro, which is a potential energy, representing 90% of all storage worldwide. The round-trip efficiency of pumped hydro-storage is anywhere from 70% to 87%. “Round trip” efficiency refers to the losses on an energy journey from electricity to potential energy as water pumped to an elevated position, and then returning to electricity when the water flows down through a turbine and into electricity again. For pumped hydro the pump and the turbine are one and the same system.

Until recently, energy storage has been primarily catered for in Ireland through pumped hydro at Turlough Hill, where it can store up to 7 hours of 292 [MW] capacity, with a round trip efficiency of 51%. There is a 360 [MW] 5 hour pumped hydro storage facility in the pre-planning phase with a theoretical completion date in 2030 (Murphy, 2023).

We have recently (2016) started to delve into other storage options like Long Duration Energy Storage (LDES) electric batteries. “Long Duration” implies hours or days (anything from 2 to 100 hours). These batteries are currently only required to balance the grid frequency, delivering power at a millisecond notice, and are not designed to arbitrage energy storage in any meaningful way over longer periods of days, weeks, or months. The battery storage industry in Ireland do however want to have batteries included as a type of Peaker supply for the future.

Ireland has estimates of 3.5 [GW] battery storage capacity currently in planning, with 692 [MW] up and running to date (Energy Storage Ireland, 2022 & 2023), with the vast majority supplying storage of around 1 to 2 hours. Growth in the technology hopes to see average storage capacity rise to 4 hours in time, with maximum storage of up to 8 hours (EirGrid, 2023). However, this is still an extremely low timeframe to satisfy grid supply security issues. Collectively, the battery industry has raised concerns that there is no national strategy for energy storage, with developments to date being “fractured and not all that coordinated” (Hoare, 2023).

Batteries with a maximum storage of 8 hours will however only ensure grid security, stability, and operability if they get replenished by surplus energy (more supply than demand) daily. This scenario is not feasible under the many observable instances of prolonged low wind conditions that can last for days and even weeks in Ireland (Cradden & Mc Dermott, 2018). Rigorous simulation of worst-case weather scenarios alongside the proposed dominant renewable energy supply needs to be undertaken, particularly with the assumption that batteries will not have developed beyond the existing storage time limitations. Battery de-rated capacity factors on the grid vary quite a bit depending on the maximum capacity and the number of hours it can deliver for, and it can range from 5% up to 50% (SEMO, 2022). Batteries generally fall into round trip efficiencies of between 85% and 90%.

As a key component in the Government’s renewable transition there are legitimate concerns as to the current state of the art in battery storage technologies that would be called on to provide grid security for this under extreme prolonged low wind and solar conditions. There is little evidence of these concerns being addressed by the government or its departments overseeing the implementation.

It is also being proposed that electrical energy is stored in electric vehicles and is given back to the grid when it comes upper stress, in a scheme that’s referred to as Vehicle-to-Grid (V2G). Like the limited battery storage-time issue, this is only a very short-term load balancing measure, not a long-term energy storage strategy.

Batteries on the grid are thus designed to rapidly come online when some main supply goes offline unexpectantly, and the battery stays on until natural gas Peaker plants (gas turbines) come up to speed after a few minutes to take over. Currently, batteries are kept in reserve to only provide absolute emergency backup.

Future total battery integration onto the grid will be critically required because of the inherent instability of the growing percentage of non-synchronous supply on the grid, and whilst there are no subsidies for the battery storage industry currently (O’Sullivan, 2023), the call for them indicates an additional cost to the whole grid system as a contractual market need. Due to the low timeframe of battery use on the grid, this resembles more of a “Demand Response” ancillary service than a strictly energy storage facility, and like all ancillary services they put an additional cost onto the grid, ultimately borne by the customer.

For longer storage solutions, governments and industry is predominantly looking at hydrogen production as being the most likely. Hydrogen is produced via electrolysing water into hydrogen (and oxygen), however massive financial uncertainty still exists around its round-trip efficiency, and future development (Robb, 2023). Round trip here refers to the way excess electricity becomes hydrogen, which is then stored, then sent onto a gas turbine to produce work that ultimately becomes electricity again, which is a round trip. The current round-trip efficiency is around 30% (Kennedy, 2023), with the potential to go to 40% in the future (Escamilla et al. 2023). The Irish government has targeted the installation of 2 [GW] of off-shore wind power exclusively dedicated to hydrogen production, ambitiously forecast to be installed and running by 2030 (EirGrid, 2023).

What is worth stating clearly is batteries are not a long-term flexible load solution like hydrogen production, and hydrogen production will find it difficult to overcome the competitive disadvantage of such poor round-trip efficiencies, unless highly subsidised by the exchequer. Therefore, what can be observed is that the storage options currently being proposed are either inadequate, unproven, or economically sustainable.

Having exhausted all the supply options in securing the grid, attention turns to the demand for electricity, and in particular ways to induce, compel or encourage reduction in times of grid distress.

Demand Response

Demand Response (DR) is a strategy used by Transmission System Operators (TSOs) like EirGrid to manage and balance the difference in supply and demand for electricity, particularly during peak usage periods. It involves contracting, incentivising, or requiring consumers to reduce their electricity usage during times of high demand, usually in response to price signals or notifications from the TSO. The goal of demand response is to reduce the strain on the power grid and prevent blackouts or brownouts during peak demand periods where there is no additional dispatchable supply to call on.

DR is fast becoming an important tool for managing the electricity grid as renewable energy sources, such as wind and solar power, become more prevalent, and the baseload dispatchable capacity is no longer overwhelmingly there as a backup to time when demand is high, and supply is low. Therefore, when power sources are intermittent and difficult to predict, DR can help balance the grid and ensure reliability and uninterrupted supply of electricity.

Smart meters are an example of demand side flexibility in the home that can ultimately encourage or discouraging electricity use with price signals indicating when the grid is under stress and requires load shedding, or when the grid is oversupplied and needs demand to pick up.

Another more structured example of how demand side flexibility will be developed is through contractually obliging companies with large electricity demands to turn off when the grid requires them to do so, and these are known as Demand Side Units (DSUs). DSU sites can provide demand side flexibility which can be dispatched as if it were a generator. An individual demand site is typically a medium to large industrial premises. In the Capacity Market, DSUs typically are awarded 1-year contracts therefore the DSU capacity varies each year. Currently there is 639 [MW] of grid demand side flexibility in the form of DSUs that can be turned down or off when the TSO requires them to, representing a 9% flexibility in demand. DSU’s have a de-rated capacity that depends on their maximum capacity and duration of operation varying between 5% and 50% (SEMO, 2022). EirGrid gives the 639 [MW] of DCU capacity a 30% de-rating, delivering a de-rated capacity of 281 [MW]. These are historically large manufacturing plants with low costs in halting production like aluminium smelting. While data centres are generally not conducive to demand response, AI computation, and its rapid growth, does have attributes that lends itself to DR.

Under the Irish Climate Action Plan 2023 the Irish government is aiming to enhance demand side flexibility to between 15% and 20% in the short-term, with EirGrid explicitly seeking between 20-50% demand flexibility in the longer-term future (EirGrid, 2023). It is envisaged that there will be 745 [MW] of DSUs to accommodate this goal (EirGrid, 2024). However, the utilisation of DCU is nascent and reliability of those DSUs doing so in a response required by EirGrid is something that has not been fully tested to date, and the confidence by which the stated capacity is delivered is yet to be fully seen. DSUs are currently projected to contractually get to 745 [MW] by 2028, beyond which is not mapped yet, other than indicatively following the Climate Action Plan. To get to an albeit lofty 20% demand flexibility by 2030 proposed by Eirgrid it would require 1,400 [MW] of DR capacity, and if de-rated at 30% would require 4,660 [MW] outright DR capacity.

As stated in EirGrid’s grid security report, a crucial element of our future grid planning is “ensuring electricity supplies meet demand, even during long periods of cold weather with little or no available wind resource”. DSUs are an interesting area to keep an eye on to see if the capacity does indeed grow, as there are not many industries that have the luxury of being able to turn off like this without substantial production and equipment costs. Data centres, for example, cannot be so easily turned off and there are no examples to date of this being the case. However, bitcoin mining can easily cater to this flexible load requirement and has a proven track record of doing so (Carter et al., 2023).

Bitcoin mining is a highly flexible demand that can be easily integrated into a demand response system, as mining can be instantly switched off without any difficulty. The signal for miners to turn off can be contractual, obliged to turn off with compensation, or it can be purely on price signals, where grid electricity becomes too costly in comparison to the bitcoin block reward for expended electricity. Indeed, an example of this is where on the 17th of January 2024 an estimated 25% of the global bitcoin network hash-rate went offline in response to the severe cold weather in the US putting pressure on the Texas electric grid signalling the bitcoin miners to turn off in a demand response operation (Hunt, 2024).

Grid Operation – Summary

The fundamental principle of thermodynamics asserts that energy is neither created nor destroyed; rather, it undergoes transformation from one location to another. All those involved in expanding the electrical grid, advancing the economy, and improving the standard of living must bear in mind this law, recognizing that the utilisation of energy is a continual process rather than a finality.

The national grid of Ireland is currently delivering 40% renewable energy, with the aim to get to 80% by 2030. To achieve this, the grid is currently undertaking a world leading shift from a fossil fuel baseload network to a 95% non-synchronous one, and it will require substantial advancement on the generation, transmission, storage, and demand response to achieve it.

With this, there remains a lot of unanswered questions about the viability of the implementing government plans to generate 80% of electricity from renewable source by 2030, particularly regarding the timely delivery of grid interconnections, genuinely long duration battery storage options, and whether the new gas-powered generation plants secured via the capacity auction for 2027 onwards actually get built. Furthermore, on the demand side there could very well be an underestimation of the growth of heating, electric cars and data centres putting even more pressure on the already stretched grid network.

As clearly seen, the government of Ireland has a major influence on how electricity is produced, stored, and transmitted, with subsidies and stringent regulation leaving it difficult to get true energy price signals from the market. Signs would also suggest the government of Ireland is committed to regulating how energy is consumed too, with data centres being a notable target. With that in mind, whilst Eirgrid may convey the need for innovative approaches to securing future growth and stability of the grid, any innovation on the electric grid must be given tacit approval by the Irish government before it could realistically be implemented by private industry.

As deliberated, the grid moving towards a dominant non-synchronous supply is going to lead to times where demand absolutely needs to reduce when supply is low (as in Demand Response), but then also times when supply will need to be curtailed when demand is low, thus leading to a growth in stranded energy from these non-synchronous supplies. Price signals on an open market should be the ultimate arbiter of how those dynamics play out.

Download a PDF copy of this report here.

Bibliography

Abnett, K., Volcovici, V., and Stanway, D., (2023), “Countries promise clean energy boost at COP28 to push out fossil fuels”, Reuters, published Dec 2023, available at https://www.reuters.com/sustainability/climate-energy/over-110-countries-set-join-cop28-deal-triple-renewable-energy-2023-12-02/

Ainger, J., (2023), “Wind sector needs energy prices in the EU to rise, says Eurelectric president”, Irish Independent, published Nov 2023, available at https://www.independent.ie/business/wind-sector-needs-energy-prices-in-the-eu-to-rise-says-eurelectric-president/a1096839609.html [accessed Dec 2023]

Allen, L., (2023), “EirGrid, CRU secure just 15% of additional power supply target in failed power plant auction”, Business Post, published November 2023, available at https://www.businesspost.ie/news/EirGrid-cru-secure-just-15-of-additional-power-supply-target-in-failed-power-plant-auction/ [accessed Jan 2024]

Bastian-Pinto, C.L, V. de S. Araujo, F., Brandao, L. and Gomes, L., (2021), “Hedging renewable energy investments with Bitcoin mining”, Renewable and Sustainable Energy Reviews, Volume 138, March 2021, available at https://doi.org/10.1016/j.rser.2020.110520

Batten, D., (2023), “more than half of bitcoin mining is fuelled by sustainable power”, Business Insider, published February 2023, available at https://markets.businessinsider.com/news/stocks/more-than-half-of-bitcoin-mining-is-fueled-by-sustainable-power-1032112511 [accessed Jan 2024]

Birrell, I., (2024), “The African village mining Bitcoin”, UnHerd Online, published 5th January 2024, available at https://unherd.com/2024/01/the-african-village-mining-bitcoin/ [accessed Jan 2024]

Bitcoin Network Ireland, (2023), “How Local Businesses Can Accept Bitcoin Payments”, published Nov 2023, available at https://bitcoinnetwork.ie/how-local-businesses-can-accept-bitcoin-payments/

Bitcoin Network Ireland, (2024), “34.5 hours per month stolen from Irish workers in just 1 year”, published February 2024, available at https://bitcoinnetwork.ie/hours-stolen-per-month-from-workers-in-ireland/

Bord Gáis, (2023), “Bord Gáis Energy invests over €250m in two new power plants”, published Jan 2023, available at https://www.bordgaisenergy.ie/news/bge-power-plants-1190123 [accessed Mar 2024]

Bray, A., (2019), “Revealed: The county that splashes the most cash on eating out and takeaways”, Irish Independent, published August 2019, available at https://www.independent.ie/irish-news/revealed-the-county-that-splashes-the-most-cash-on-eating-out-and-takeaways/38422692.html

Bruno, A., Weber, P., and Yates, A.J., (2023), “Can Bitcoin mining increase renewable electricity capacity?”, Resource and Energy Economics, Volume 74, August 2023, 101376, available at https://doi.org/10.1016/j.reseneeco.2023.101376

Campbell, D. and Larsen, A., (2023), “Bitcoin and the Energy Transition: From Risk to Opportunity”, Institute of Risk Management, published 2023, available at https://www.theirm.org/news/bitcoin-and-the-energy-transition-from-risk-to-opportunity/ [accessed Nov 2023]

Carey, T., (2024), “Planning application for 710MW gas-fuelled power plant near Rhode”, Offaly Independent, published Feb 2024, available at https://www.offalyindependent.ie/2024/02/16/planning-application-for-710mw-gas-fuelled-power-plant-near-rhode/

Carter, N, Connell, S., Jones, B., Porter, D., and Rudd, M.A., (2023), “Leveraging Bitcoin Miners as Flexible Load Resources for Power System Stability and Efficiency”, published November 2023, available at SSRN: https://ssrn.com/abstract=4634256 or http://dx.doi.org/10.2139/ssrn.4634256

Cambridge Centre for Alternative Finance, (2023), “Cambridge Bitcoin Electricity Consumption Index”, available at https://ccaf.io/cbnsi/cbeci [accessed Dec 2023]

CSO, (2023), “Census of Population 2022 – Summary Results, Household Size and Marital Status”, Central Statistics Office, published May 2023, available at https://www.cso.ie/en/releasesandpublications/ep/p-cpsr/censusofpopulation2022-summaryresults/householdsizeandmaritalstatus/ [accessed Mar 2024]

CSO, (2023), “Metered Electricity Consumption 2022”, Central Statistics Office, published June 2023, available at https://www.cso.ie/en/releasesandpublications/ep/p-mec/meteredelectricityconsumption2022/keyfindings/ [accessed Mar 2024]

Collins, J., (2023), “How many are too many? Facts, emotion, and the great data centre debate”, The Currency, published Nov 2023, available at https://thecurrency.news/articles/133536/how-many-are-too-many-facts-emotion-and-the-great-data-centre-debate/ [accessed Feb 2024]

Consolvo, B. and Caron, K., (2023), “Bitcoin’s role in the ESG imperative”, KPMG, available at https://kpmg.com/us/en/articles/2023/bitcoin-role-esg-imperative.html.

Commission for Regulation of Utilities, (2023), “Electricity Security of Supply Programme of Work Update February 2023”, published Feb 2023, available at https://www.cru.ie/publications/27388/ [accessed Feb 2024]

Cradden, L., and McDermott, F., (2018), “A weather regime characterisation of Irish wind generation and electricity demand in winters 2009–11”, Environmental Research Letters, Volume 13, Number 5, available at https://iopscience.iop.org/article/10.1088/1748-9326/aabd40

Cunniffe, N., (2019), “IWEA Position Paper on Priority Dispatch and Compensation for Constraint and Curtailment, arising from EU Regulation 2019/943”, published November 2019, available at https://windenergyireland.com/images/files/20191115-iwea-position-paper-on-priority-dispatch-and-compensation-for-constraint-and-curtailment.pdf

Department of Environment, Climate and Communications, (2023), “Energy Security in Ireland to 2030”, available at https://www.gov.ie/en/publication/5c499-energy-security-in-ireland-to-2030/

Department of Environment, Climate and Communications, (2023), “Climate Action Plan 2023”, available at https://www.gov.ie/en/publication/7bd8c-climate-action-plan-2023/

Department of Environment, Climate and Communications, (2022), “New legislation introduced for the Energy Efficiency Obligation Scheme”, available at https://www.gov.ie/en/press-release/e5331-new-legislation-introduced-for-the-energy-efficiency-obligation-scheme/

Development (Emergency Electricity Generation) Act, (2022), Number 35 of 2022, Irish Government, Dublin: Stationery Office, available at https://www.irishstatutebook.ie/eli/2022/act/35/enacted/en/pdf [accessed Feb 2024]

EirGrid Group, (2019), “All-Island Generation Capacity Statement 2019 – 2028”, available at https://www.eirgrid.ie/site-files/library/EirGrid/EirGrid-Group-All-Island-Generation-Capacity-Statement-2019-2028.pdf

EirGrid Group, (2023), “Smart Grid Dashboard”, available at https://www.smartgriddashboard.com/#all [accessed Mar 2024]

EirGrid Group, (2023), “Tomorrow’s energy scenarios 2023 – Consultation report”, available at https://www.EirGridgroup.com/site-files/library/EirGrid/Tomorrows-Energy-Scenarios-2023-Consultation-Report.pdf

EirGrid Group, (2023), “Shaping Our Electricity Future Version 1.1 Roadmap”, published July 2023, available at https://www.eirgrid.ie/site-files/library/EirGrid/Shaping-Our-Electricity-Future-Roadmap_Version-1.1_07.23.pdf

EirGrid Group, (2023), “RESS 3 Provisional Auction Results – Renewable Electricity Support Scheme”, published September 2023, available at https://www.EirGridgroup.com/site-files/library/EirGrid/RESS-3-Provisional-Auction-Results-(R3PAR).pdf

EirGrid Group, (2023), “Annual Renewable Energy Constraint and Curtailment Report 2022”, published May 2023, available at https://www.eirgrid.ie/site-files/library/EirGrid/Annual-Renewable-Constraint-and-Curtailment-Report-2022-V1.0.pdf

EirGrid Group, (2023), “Winter Outlook 2023/24”, published October 2023, available at https://www.eirgrid.ie/site-files/library/EirGrid/ROI-Winter-Outlook-Report_2023.pdf

EirGrid Group, (2024), “Ten-Year Generation Capacity Statement 2023 – 2032”, available at https://cms.EirGrid.ie/sites/default/files/publications/19035-EirGrid-Generation-Capacity-Statement-Combined-2023-V5-Jan-2024.pdf

EirGrid Group, (2024), “Ireland records new record peaks for electricity demand due to cold weather”, available at https://www.eirgrid.ie/news/ireland-records-new-record-peaks-electricity-demand-due-cold-weather [accessed Mar 2024]

ERCOT, (2022), “2022 State of the Market Report for the ERCOT Electricity Markets”, Potomac Economics, published May 2023, available at https://ftp.puc.texas.gov/public/puct-info/industry/electric/reports/ERCOT_annual_reports/2022annualreport.pdf

European Commission, (2021), “Directive of the European Parliament and of the Council on Energy Efficiency”, published July 2021, available at https://opac.oireachtas.ie/Data/Library3/Documents%20Laid/2021/pdf/DECCdocslaid230821_230821_115442.pdf

European Commission, (2023), “Quarterly report On European electricity markets – Market Observatory for Energy”, DG Energy, Volume 16 (issue 2, covering the second quarter of 2023), available at https://energy.ec.europa.eu/system/files/2023-12/New_Quarterly_Report_on_European_Electricity_markets_Q2_2023.pdf

Energy Storage Ireland, (2023), “Behind-the-Meter Storage: An Energy Solution for Ireland”, Published July 2023, available at https://www.energystorageireland.com/wp-content/uploads/2023/07/Energy-Storage-Ireland-Behind-the-Meter-Storage-White-Paper.pdf

Energy Storage Ireland, (2022), “Energy Storage Ireland: A Procurement Framework for Long-Duration Energy Storage”, published June 2022, available at https://www.energystorageireland.com/wp-content/uploads/2022/11/ESI-Position-Paper-on-a-Procurement-Framework-for-Long-Duration-Energy-Storage.pdf

Escamilla, A., Sanchez, D. and García-Rodríguez, L., (2023), “Assessment of power-to-power renewable energy storage based on the smart integration of hydrogen and micro gas turbine technologies”, International Journal of Hydrogen Energy, Volume 47, Issue 40, 8 May 2022, Pages 17505-17525, available at https://doi.org/10.1016/j.ijhydene.2022.03.238

FSR, (2023), “Contracts for Difference”, available at https://fsr.eui.eu/contracts-for-difference/

Gas Networks Ireland, (2023), “Biomethane Energy Report”, Published September 2023, available at https://www.gasnetworks.ie/docs/business/renewable-gas/biomethane-energy-report.pdf

Gkousarov, T., (2023), “Weather tracker: power prices dip to negative in Europe amid clean energy boost”, The Guardian, published May 2023, available at https://www.theguardian.com/environment/2023/may/29/weather-tracker-power-prices-dip-to-negative-in-europe-amid-clean-energy-boost

Goodbody, W., (2024), “One Giga Watt of solar capacity now connected to electricity grid”, RTE, published February 2024, available at https://www.rte.ie/news/business/2024/0226/1434383-1gw-of-solar-capacity-now-connected-to-electricity-grid/ [accessed Mar 2024]

Gov.uk (2023), “Boost for offshore wind as government raises maximum prices in renewable energy auction”, available at https://www.gov.uk/government/news/boost-for-offshore-wind-as-government-raises-maximum-prices-in-renewable-energy-auction [accessed Nov 2023]

Hamilton, A., (2023), “How this former beef farmer is turning his grass into mining for bitcoin”, Irish Independent, published May 2023, available at https://www.independent.ie/farming/agri-business/how-this-former-beef-farmer-is-turning-his-grass-into-mining-for-bitcoin/a1236394378.html [accessed Dec 2023]

Healy, E., (2022), “Record-breaking grocery inflation in Ireland set to see Christmas spend hit €1.25 billion for the first time”, Kantar Consulting Company, published December 2022, available at https://www.kantar.com/uki/inspiration/fmcg/2022-wp-record-breaking-grocery-inflation-in-ie-set-to-see-xmas-spend-hit-1-25-bn-for-the-first-time [accessed Mar 2024]

Hoare, P., (2023), “Ireland sees big opportunity in battery storage”, Irish Examiner, published May 2023, available at https://www.irishexaminer.com/business/technology/arid-41142121.html [accessed Jan 2024]

Hunt, J., (2024), “Bitcoin mining hashrate falls by an estimated 25% amid Texas curtailment”, The Block, published January 2024, available at https://www.theblock.co/post/273159/bitcoin-mining-hashrate-falls-texas-curtailment

Ibañez, J. and Freier, A., (2023) “A Bitcoin’s Carbon Footprint Revisited: Proof of Work Mining for Renewable Energy Expansion Challenges”, Challenges 2023, 14(3), 35; available at https://doi.org/10.3390/challe14030035

Jack, K., (2022), “How much do we know about the development impacts of energy infrastructure?”, World Bank, published March 2022, available at https://blogs.worldbank.org/energy/how-much-do-we-know-about-development-impacts-energy-infrastructure

Joshi, S. and Deane, P., (2021), “Quantifying the potential for rooftop solar photovoltaic in Ireland”, available at https://www.marei.ie/wp-content/uploads/2022/07/Quantifying-the-Potential-for-Rooftop-Solar-Photovoltaic-in-Ireland.pdf & https://theconversation.com/solar-panels-on-half-the-worlds-roofs-could-meet-its-entire-electricity-demand-new-research-169302 [Online Resource] [accessed Jan 2024]

Joyce-O’Caollai, C., (2022), “The future of waste to energy”, Indaver, published May 2022, available at https://indaver.com/news/single/the-future-of-waste-to-energy [accessed Dec 2023]

Kennedy, R., (2023), “US researchers evaluate viability of ‘direct’ green hydrogen fuel production”, PV Magazine, published March 2023, available at https://www.pv-magazine.com/2023/03/22/us-researchers-evaluate-viability-of-direct-green-hydrogen-fuel-production/ [accessed Dec 2023]

Lal, A., Zhu, J., and You, F., (2023), “From Mining to Mitigation: How Bitcoin Can Support Renewable Energy Development and Climate Action”, CS Sustainable Chem. Eng. 2023, 11, 45, 16330–16340, publication Date October 27, 2023, available at https://doi.org/10.1021/acssuschemeng.3c05445

Lehane, M., (2024), “One Giga Watt of solar capacity now connected to electricity grid”, RTE, published February 2024, available at https://www.rte.ie/news/business/2024/0226/1434383-1gw-of-solar-capacity-now-connected-to-electricity-grid/ [accessed Mar 2024]

Maynes, M., (2023), “Wind turbine maker Siemens facing bailout from German government as shares plunge”, Gript, published Nov 2023, available at https://gript.ie/wind-turbine-maker-siemens-facing-bailout-from-german-government-as-shares-plunge/

Millard, R., (2023), “Siemens Energy seeks government guarantees as wind crisis deepens”, Financial Times, published Oct 2023, available at https://www.ft.com/content/8032d923-4765-407c-bd89-d2f4d02ff4ef

Mims, C., (2023), “AI Is Ravenous for Energy. Can It Be Satisfied?”, Wall Street Journal, published December 2023, available at https://www.wsj.com/tech/ai/ai-energy-consumption-fc79d94f

Min, R., (2023), “Amid Europe’s energy crisis, this Dutch tulip farmer is swapping gas for heat from Bitcoin mining”, Euronews, published Dec 2022, available at https://www.euronews.com/next/2022/12/14/a-bitcoin-miner-and-tulip-grower-team-up-to-reduce-costs [accessed Dec 2023]

Morison, R., (2023), “Strong Wind Generation Turns European Power Prices Negative”, Bloomberg, published December 2023, available at https://www.bloomberg.com/news/articles/2023-12-27/strong-wind-generation-turns-european-power-prices-negative

Mulligan, J., (2023), “DCC boss questions Irish capacity to fully electrify the economy”, Irish Independent, published Nov 2023, available at https://www.independent.ie/business/irish/dcc-boss-questions-irish-capacity-to-fully-electrify-the-economy/a1778700960.html [accessed Dec 2023]

Murphy, P., (2023), “Investor says Silvermines hydro project is an exciting opportunity”, TippFM , available at https://tippfm.com/news/energy-environment/investor-says-silvermines-hydro-project-exciting-opportunity/ [accessed Nov 2023]

National Grid, (2019), “De-rating Factor Methodology for Renewables in the CM”, National Grid ESO, published February 2019, available at https://www.emrdeliverybody.com/CM/Capacity.aspx

Ourworldindata.org, (2024), “Total electricity generation per person, 2022”, available at https://ourworldindata.org/grapher/per-capita-electricity-generation [accessed Mar 2024]

Ourworldindata.org, (2024), “Energy use per person, 2022”, available at https://ourworldindata.org/grapher/per-capita-energy-use [accessed Mar 2024]

Ourworldindata.org, (2020), “CO₂ emissions” https://ourworldindata.org/co2-emissions [accessed March 2024]

Ourworldindata.org, (2024), “Energy Production and Consumption”, available at https://ourworldindata.org/energy-production-consumption [accessed Mar 2024]

Ourworldindata.org, (2024), Energy use per person vs. GDP per capita, 2021, available at https://ourworldindata.org/grapher/energy-use-per-person-vs-gdp-per-capita [accessed Mar 2024]

Ourworldindata.org, (2024), “Renewable Energy”, available at https://ourworldindata.org/renewable-energy [accessed Mar 2024]

O’Connell, S., (2023), ” District heating finally comes to Ireland”, Irish Times, published October 2023, available at https://www.irishtimes.com/special-reports/2023/10/26/district-heating-finally-comes-to-ireland/ [accessed Feb 2024]

O’Doherty, C., (2023), “Free electricity for tens of thousands of households from surplus supply in ‘windy day scheme’”, Irish Independent, published Jan 2023, available at https://www.independent.ie/news/free-electricity-for-tens-of-thousands-of-households-from-surplus-supply-in-windy-day-scheme/42285556.html [accessed Dec 2023]

O’Halloran, B., (2021), “High-emissions electricity plants may have to stay open to avoid power cuts”, Irish Times, published September 2021, available at https://www.irishtimes.com/business/energy-and-resources/high-emissions-electricity-plants-may-have-to-stay-open-to-avoid-power-cuts-1.4686114 [accessed Dec 2023]

O’Sullivan, K., (2022), “Rooftop solar panels could produce 25% of household electricity, UCC study finds”, Irish Times, published July 2022, available at https://www.irishtimes.com/environment/2022/07/01/rooftop-solar-panels-could-produce-25-of-household-electricity-according-to-ucc-study/ [accessed Dec 2023]

O’Sullivan, K., (2023), “Ireland’s lead role in battery storage ‘needs fine tuning’ as renewables scale up, industry expert says”, Irish Times, published January 2023, available at https://www.irishtimes.com/business/innovation/2023/01/27/irelands-lead-role-in-battery-storage-needs-fine-tuning-as-renewables-scale-up-industry-expert-says/ [accessed Jan 2024]

Ritchie, H., (2021) – “A number of countries have decoupled economic growth from energy use, even if we take offshored production into account” OurWorldInData.org, available at https://ourworldindata.org/energy-gdp-decoupling [Online Resource] [accessed Dec 2023]

Robb, S., (2022), “Watch: mining bitcoin on top of an AD plant”, Irish Farmers Journal, Published 21st Dec 2022, available at https://www.farmersjournal.ie/focus/renewables/mining-bitcoin-on-top-of-an-ad-plant-739296 [accessed Dec 2023]

Robb, S., (2023), “Hydrogen race heats up with two new plants on way”, Irish Farmers Journal , published July 2023, available at https://www.farmersjournal.ie/news/news/hydrogen-race-heats-up-with-two-new-plants-on-way-774529 [accessed Dec 2023]

Steitz, C. and Hübner, A., (2023), “Siemens Energy reviews wind unit set-up after €4.6 billion loss”, Reuters, published Nov 2023, available at https://www.reuters.com/business/energy/siemens-energy-reviews-structure-wind-unit-after-5-bln-loss-2023-11-15/ [accessed Dec 2023]

SEAI, (2018), “National Energy Projections to 2030”, Sustainable Energy Authority of Ireland, published Nov 2018, available at https://www.seai.ie/publications/National-Energy-Projections-to-2030.pdf

SEAI, (2022), “Energy in Ireland 2022”, Sustainable Energy Authority of Ireland, published Dec 2022, available at https://www.seai.ie/publications/Energy-in-Ireland-2022.pdf

SEAI, (2023), “National Energy Projections 2023”, Sustainable Energy Authority of Ireland, published Nov 2023, available at https://www.seai.ie/publications/National-Energy-Projections-2023.pdf

SEAI, (2024), “Solar Atlas”, Sustainable Energy Authority of Ireland, available at https://gis.seai.ie/solar/ and https://globalsolaratlas.info/ [accessed Feb 2024]

SEMO, (2019), “Capacity Market: The Quick Guide to Understanding Qualification”, published March 2019, available at https://sem-o.com/documents/general-publications/Capacity-Market-The-Quick-Guide-to-Understanding-Qualification.pdf

SEMO, (2022), “2023/2024 T-1 Capacity Auction Initial Auction Information Pack”, published December 2022, available at https://www.sem-o.com/documents/general-publications/Initial-Auction-Information-Pack_IAIP2324T-1.pdf

SEMOpx, (2023), “Wholesale Electricity Prices Ireland”, available at https://www.semopx.com/documents/general-publications/Lookback2_mkt.xlsx [accessed Mar 2024]

Sigalos, M. & Smith, J., (2023), “Texas paid bitcoin miner Riot $31.7 million to shut down during heat wave in August”, CNBC, available at https://www.cnbc.com/2023/09/06/texas-paid-bitcoin-miner-riot-31point7-million-to-shut-down-in-august.html [accessed Jan 2024]

SONI, (2022), “EirGrid & SONI Generation Capacity Statement 2022-2023, available at https://www.soni.ltd.uk/media/documents/EirGrid_SONI_2022_Generation_Capacity_Statement_2022-2031.pdf

SSE, (2024), “Tarbert Next Generation Power Station”, available at https://ssetarbertnextgen.com [accessed Jan 2024]

Statista, (2024), “ s for selected energy sources in the United States in 2022”, available at https://www.statista.com/statistics/183680/us-average-capacity-factors-by-selected-energy-source-since-1998/ [accessed Feb 2024]

Walton, R., (2022), “Morning Mull: Relative Construction Costs and Land use of Solar, Wind and Natural Gas plants”, available at https://www.energytech.com/energy-efficiency/article/21251823/morning-mull-relative-construction-costs-and-land-use-of-solar-wind-and-natural-gas-plants [accessed Mar 2024]

Wang, B., (2024), “What Does Elon Saying 10X AI Every 6 Months Means for Dojo and Tesla”, published by Next Big Future, published January 2024, available at https://www.nextbigfuture.com/2024/01/what-does-elon-saying-10x-ai-every-6-months-means-for-dojo-and-tesla.html

Wilson, J., (2023), “Building nuclear power plants in Ireland would be “immoral” – Campaigner”, Newstalk, published July 2023, available at https://www.newstalk.com/news/building-nuclear-reactors-in-ireland-would-be-immoral-campaigner-1492307

Wu, S., Li, C and Wei, C., (2022), “Electricity consumption as a new indicator of inequality”, Energy Research & Social Science, Volume 90, August 2022, available at https://doi.org/10.1016/j.erss.2022.102677