Step-by-step guide on accepting Bitcoin payments for your retail business. Learn the process, benefits, and secure your place in the future of commerce.

Introduction

Bitcoin, originally conceived as a decentralised peer-to-peer electronic cash system, is increasingly gaining recognition for its practical applications that extend beyond its conventional role as an investable asset. As businesses, ranging from local cafes to retail chains, explore Bitcoin’s potential for everyday transactions, the broader implications for the business landscape come into focus.

This article delves into the advantages of incorporating Bitcoin as a payment method for retail businesses. It examines both the immediate benefits, like cost savings through low transaction fees, and the long-term strategic advantages associated with early adoption and value preservation. As Bitcoin’s integration into commerce continues to develop, grasping its potential becomes imperative for forward-thinking businesses.

Why Local Businesses Should Accept Bitcoin

First of all, bitcoin was designed to be superior money; this is predicated by the fact that the money we use today must be flawed in some way. This superiority as money derives primarily from its limited supply (21 million coins), in stark contrast to the banking system’s pernicious and persistent monetary expansion; the primary driver of inflation. Additionally, Bitcoin utilises triple entry bookkeeping, which eliminates the need for transaction intermediaries. Its decentralised network, secured by proof-of-work mining and Sha-256 cryptography, makes it exceptionally resilient. Notably, Bitcoin is a bearer asset, which means ownership is akin to physical possession, offering unparalleled control and security to the user. As it is a protocol and not an organisation, Bitcoin operates without the permission of any central authority, ensuring trust, transparency, and fairness in all transactions. The network doesn’t recognise borders, making it a true global money between people.

We strongly advise that you learn about Bitcoin before taking any steps to adopt it as a method of payment or savings for your company. It’s also worth noting that Bitcoin and ‘crypto’ are not the same. We do not offer advice on other cryptocurrencies and strongly advise avoiding them.

What Are The Benefits of Accepting Bitcoin?

Three standout benefits of accepting Bitcoin are:

- Grow Revenue from energetic, tech-savvy and potentially hugely loyal customers. Those who own bitcoin are are often delighted to pay & tip in bitcoin, they regularly travel far and wide just to visit and support local businesses which accept bitcoin.

- Save on Fees: Merchants can save 2-3% of credit card fees by using the Bitcoin Lightning Network. It’s worth noting that merchants can choose to auto convert Bitcoin payments into Euros, should they wish to. It’s worth remembering that Bitcoin is a growing payment network which can compliment existing payment rails, and not replace them. Well, at-least not yet.

- Preserve Value: bitcoin serves as a long-term solution to inflation, preserving the value of earnings due to its fixed supply. While the bitcoin price is volatile in the short term, over a number of years this volatility constantly drives this price higher. To explore this a little further, since January 2020 the euro has lost over 40% of its purchasing power according to OECD data. Should a business have received €100 worth of payments per month in bitcoin over the same time period; january 2020 to November 2023 (€4,600 in total), the business would have acquired 0.229 BTC, which is worth €8,025; a +74% increase.

>> How is Bitcoin’s price determined?

Other benefits include…

- Instant settlement, no chargeback risk: Settlements are final on Bitcoin, meaning charges cannot be reversed.

- Greater flexibility: Accepting bitcoin provides greater flexibility in the event of the traditional payment system falters.

- Discreet payments: The Lightning Network (discussed below) offers merchants private payments that are outside of the banking system and Bitcoin’s open ledger.

- No Counter-party necessary. You don’t have to rely upon a traditional bank or payment provider. All you need is an app, a wallet & a phone or POS.

What Businesses Does Bitcoin Suit?

Bitcoin will benefit literally any business. This article primarily concentrates on businesses that demand swift transaction processing. For such businesses, Bitcoin’s Lightning Network is exceptionally well-suited.

This includes cafes, bars, retail shops, farmers’ markets, taxi services, contractors, consultants, barbershops, suppliers and so on. Essentially, if your business seeks a cost-effective method for accepting payments, has internet access, and a mobile phone, bitcoin is a very suitable option.

Bitcoin & The Lightning Network

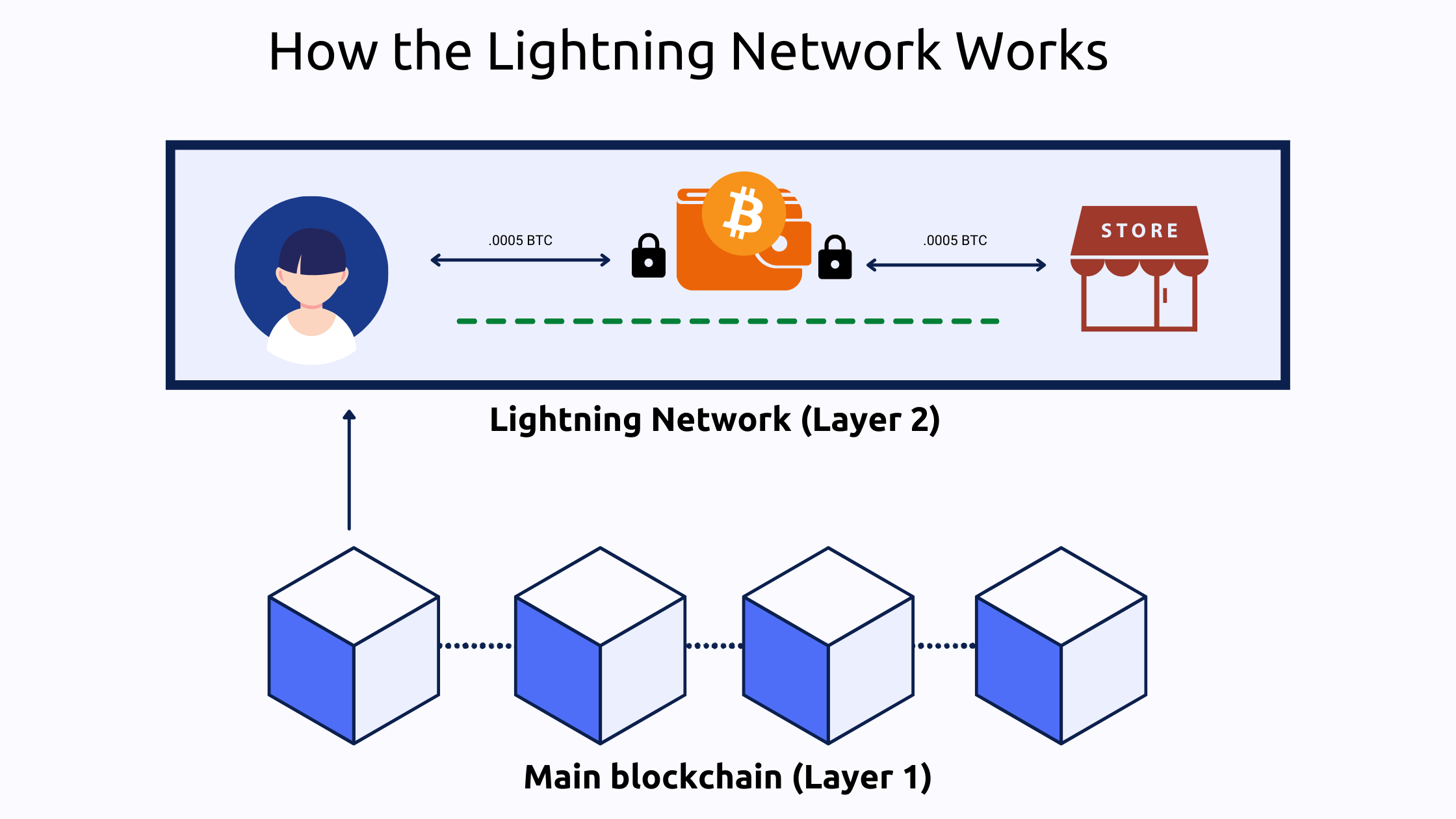

Transactions on the Bitcoin network, which is the “base layer” or “layer one”, settle every ten minutes, making it unsuitable for a busy cafe to accept payments. To speed up payments, Bitcoin developers have created a number of ‘layer two solutions’, most notably the Lightning Network, which grew rapidly by 1200% between 2021 and 2023, already settling over one billion euro annually.

The Lightning Network

The Lightning Network accelerates transactions without compromising layer one’s security – the Bitcoin blockchain itself. It works by opening a channel between the merchant and the customer using an app on a phone or a PoS system. Once the channel is closed, the received bitcoin is settled back onto the base layer. With its rapid settlement time that’s even faster than the Visa/Mastercard network, it’s perfect for local businesses such as cafes and retail shops.

For simplicity, you can think of the Lightning Network as the current account to Bitcoin’s savings account. It is the same money, under your control, but with different tradeoffs between decentralisation and scalability.

Image source: Bitpay

Bitcoin (Layer 1)

This is the foundational Bitcoin layer which is an open and transparent ledger which settles transactions approximately every ten minutes. The Bitcoin network is the most secure computing network in the world, which also makes it the most secure savings account in the world. It’s ideal for businesses handling larger amounts where immediate settlement isn’t crucial, such as buying a car or invoicing suppliers.

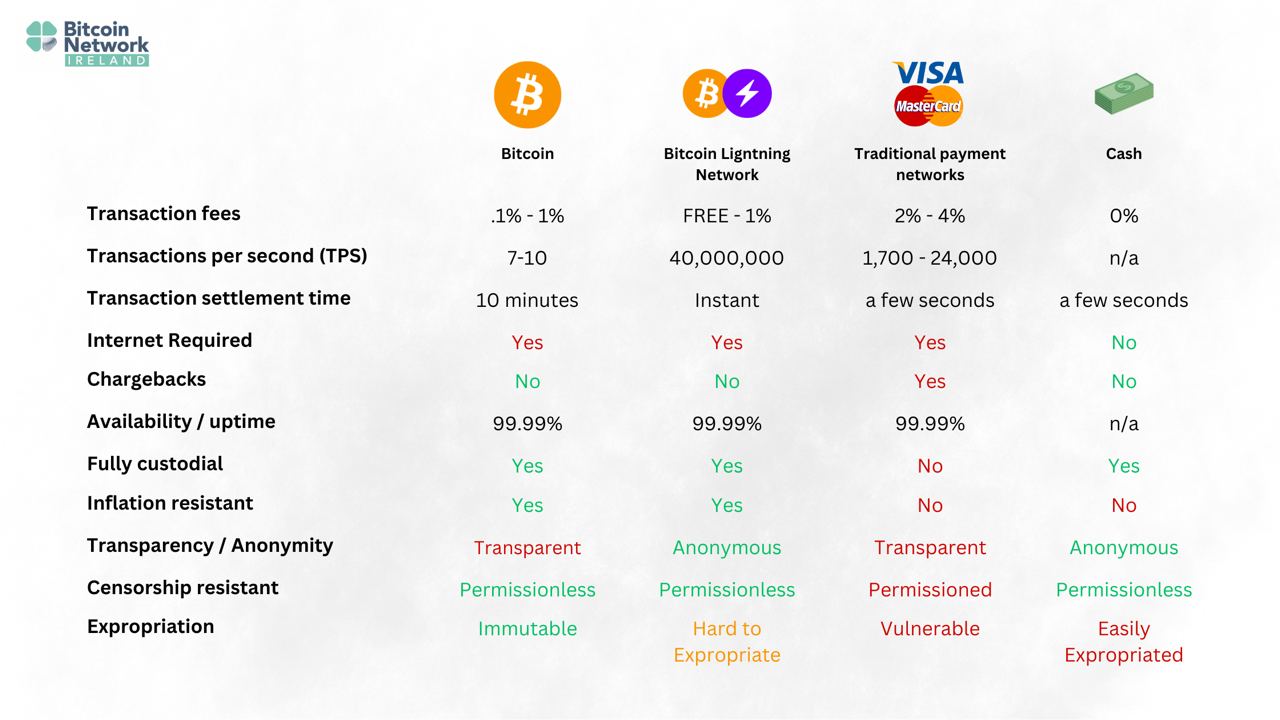

How does Bitcoin and the Bitcoin Lightning Network measure up to traditional payment solutions?

How To Implement Bitcoin In Your business?

Question: Can I use existing card readers, such as square, SumUp, Toast, Clover or Elavon to accept bitcoin payments?

In short, no. These systems are designed for regular currencies, have to deal with regulatory challenges, and they likely aren’t interested in offering the low transaction fees that the Lightning Network offers.

What You’ll Need

- A spare Android / IOS device or handheld POS receipt printer

- An internet connection

- A Bitcoin Wallet to secure your funds

- A Point-of-sale / payment app to transact with customers

Point-Of-Sale Payment Solutions

Basic lightning wallets with payment features are a suitable way to get setup to accept payments. There are some features to look out for, depending on your business needs, for example, inventory management, tax reporting, and some even allow Bitcoin payments to be received in both Bitcoin & Euros.

Ordered by increasing levels of functionality:

- Wallet of Satoshi is primarily a lightning wallet, though they introduced a limited POS product in 2023. It’s a simple solution to generate Bitcoin invoices and accept payments. Whilst its features are basic, it’s perfectly suited to single service operators or indeed businesses who wish to process transactions as they would cash. It’s also quite useful for merchants who wish to dip their toes in to see how the lightning works in its basic form. On-chain fees .5%, Lightning fees 0%.

- CoinCorner Checkout – Based on the Isle of Man, CoinCorner offers a simple Bitcoin payment solution. With CoinCorner Checkout, businesses can accept bitcoin payments in-store, online or via email invoicing. Fees are just 1% and when accepting bitcoin, merchants can either hold BTC or convert instantly to EUR which removes any risk of price volatility. Although CoinCorner can hold bitcoin on behalf of businesses, they do allow recurring lightning payments to the merchants personal wallet should they wish to custody themselves.

- Opago offers small merchants around the world to accept bitcoin in a fast, easy and secure method giving access to the Lightning Network with their own custom POS-terminals. Opago provides a merchant dashboard which details all transactions, and provides a rather useful tax reporting feature; particularly to EU merchants. The fee is 1% for all transactions processed through the POS-terminals, which cost €99 to buy.

- Swiss Bitcoin Pay is an easy to set up and KYC free solution. Business owners have the option to choose to instantly receive bitcoin in their preferred Bitcoin wallet or to auto convert bitcoin to EURO and receive the payments the following day in the selected bank account. Each account has one primary device and any number of ‘receive only’ devices, which is suitable business owners to allow employees to receive payments on their phones, but not have the ability to access the funds. Watch their 90 second promotional video.

- IBEX Pay specialises in offering enterprise payment solutions over the Lightning Network. IBEX Pay allows retailers to assign specific wallet addresses, currencies and terminals with different branches and managers. Each branch can then use the associated IBEX Pay app to receive payments. IBEX Pay allows merchants to determine whether they wish to receive the payment entirely in Bitcoin, euros or a mix of both. IBEX Pay is free to set up and fees are 0.5% to 0.7%. Watch a full demo video of IBEX Pay.

How to Process a Transaction

Whether you’ve opted for a simple lightning wallet, or a Point-of-sale app, the process to accept payments is more or less the same.

- Customer Places an Order: When a customer places an order, tally the total cost as you would for any other transaction and set the payment to cash.

- Generate a Bitcoin Invoice: Using your Bitcoin lightning payment app or POS terminal, input the total amount of the order in Euros. The app will automatically convert this amount into its equivalent in Bitcoin or Satoshis (fractions of a Bitcoin) based on the current exchange rate.

- Display the Payment Prompt: Once the invoice is generated, your app will display a QR code or activate an NFC instance for the customer to scan or tap with their phone.

- Customer Initiates Payment: The customer will then pay using one of the following methods:

-

- By scanning the QR code displayed on your device.

- By tapping their phone against yours if both devices support NFC.

- Alternatively, if the customer has a Bold card (a Bitcoin NFC card), they can tap that against the device.

- Payment Verification: Once scanned or tapped, the customer’s wallet app will display the payment details, including the amount in bitcoin / satoshis (bitcoin is divisible by 100,000,000 satoshi’s). The customer should verify that the amount and details are correct.

- Customer Approves the Transaction: After verifying the payment details, the customer will be prompted to confirm and accept the transaction on their app. They’ll click or tap the ‘Accept’ or ‘Confirm’ button.

- Transaction Confirmation: Your payment app will instantly receive the payment and notify you of a successful transaction. The Lightning Network ensures that this process is quick, often within seconds.

That’s it. Most apps provide the functionality to export transactions to a csv file so you can match-up payments received with your existing point-of-sale solution.

Take Full Custody of Bitcoin Payments

While entrusting your bitcoin to third parties may be the preferred option for some, it’s crucial to recognise the risks. If a third party mishandles your bitcoin or becomes insolvent, your business stands to lose its bitcoin. This is in contrast to traditional banks, which offer “Deposit Guarantee Schemes” that insure deposits up to €100,000, Bitcoin lacks a similar safety net in the event a provider fails to secure your bitcoin.

Premium apps often offer the option to seamlessly connect a privately secure wallet to the POS app. This allows for automatic forwarding of all transactions to the merchant’s preferred wallet. If the POS app doesn’t automatically forward bitcoin payments to your own wallet, business owners should manually initiate transfers to a secure wallet on a daily, weekly, or monthly basis. Whilst this is the preferred option for most bitcoin holders, it does transfer the risk from the point-of-sale company to the business owner. Therefore, it’s important to understand how to secure bitcoin correctly.

Transactions can be sent to a mobile lightning wallet such as Blue Wallet, Muun Wallet or Phoenix Wallet manually or automatically. On a monthly or even quarterly basis, it is recommended to secure these funds in the most secure type of wallets available; a hardware wallet. Hardware wallets are much more secure than mobile wallets as they are disconnected from the internet and less likely to be stolen than a mobile phone. BitBox 02, Blockstream Green & the Ledger Nano series are pretty good options.

Case Studies:

The case studies listed below are for two medium sized conferences with numerous pay stations. In both instances, Bitcoin Lightning was used by accept payments from customers using a variety of devices.

- Case Study 1 >> How Hodl Hodl used BTCPay to accept bitcoin payments at a conference

- Case Study 2 >> Bitcoin Atlantis Conference: €115,100 from 8,750 Transactions in 3 Days

B2B Invoicing

Zaprite, is a tech start-up founded by Dubliner, John Magill and based in Austin, USA. Businesses transitioning to the Bitcoin standard often need the ability to accept both bitcoin and fiat in one integrated payment experience for customers. The ability to add a premium or discount to the price of an item or invoice based on payment method is next on the roadmap. Zaprite provide the facility to create customised invoices that can be paid with Bitcoin or a credit/debit card. The cost of this service is approximately €20 per month, in return they reduce transaction fees down to zero.

Educate Staff & Stakeholders

As with any new technology or system adopted by a business, proficiency is critical to leverage its full potential and ensure seamless integration into existing workflows. Stakeholders need to learn about Bitcoin, so as to not make uninformed or rash decisions pertaining to the business and its Bitcoin implementation.

Meanwhile, staff members are at the forefront of daily operations, and their ability to manage bitcoin transactions effectively will directly impact customer satisfaction and the company’s reputation. Simply put, adequate knowledge safeguards the company’s assets, maintains trust with its clientele, and guarantees that the decision to adopt Bitcoin yields the desired advantages.

Accounting & Tax Considerations

It’s important to be aware of the tax implications and accounting requirements when dealing with Bitcoin. Regularly consulting with a financial advisor or accountant familiar with cryptocurrency can ensure compliance and proper reporting.

Taxation applies when the asset is being sold. So a reasonable goal for most small businesses could be (at least in the early stages) to save all or a percentage of bitcoin transactions, as they will appreciate in value over time. It’s important to keep a record of transactions, so that capital gains can be calculated accurately in due course. In fact, transactions involving ‘crypto-assets’ must be recorded and retained for 6 years.

If a company receives Bitcoin for the payment of a sales invoice, it too records the transaction in the Euro equivalent. The company then records the value of the asset on its Balance Sheet. The rules for revaluing the asset at year-end are currently under review, so I would take advice at the time on how to adjust for any changes in value of your Bitcoin holdings at year-end.

>> Talk to a professional tax advisor

Bitcoin Accepted Here

All too often, businesses accept bitcoin payments. but fail to let it known to their customers. It’s so important to let people know that your business accepts bitcoin. You can do this by following some or all of the steps below.

- Place a sign on your shop’s window or exterior wall can attract the attention of passersby, especially those already invested in bitcoin.

- Display a sticker or sign at the checkout to signify that bitcoin is a valid payment method. Stickers can be purchased here or here. If you wish to print your own sign, then you will find an assortment of promotional graphics on the Bitcoin Wiki.

- Add a prominent “Pay With Bitcoin” message on the bill so that customers recognise this option at the time of payment.

- Incentivise this further by offering a 5% discount for paying with bitcoin, assuming this is viable option.

- For those customers who are curious about bitcoin and would like the discount in the future, offer an inventive to come back and claim a new discount.

- Collaborate with local Bitcoin enthusiasts and join Bitcoin meetups to promote your services within the local Bitcoin community.

- Consider running a local PR campaign to inform the broader community about this alternative payment option.

- Add your business listing to the UK & Ireland Map & Global BTC Map.

Balance Sheets, A Long Term View

As 9% inflation continues to bite hard, businesses must solutions to counter this paralysing force. A strategic allocation of a business’s balance sheet into Bitcoin is one such solution, but it requires a well-informed, deliberate approach, and a tolerance for the asset’s volatility.

This approach is best exemplified by MicroStrategy’s foray into Bitcoin, with its acquisition of approximately 158,000 BTC since 2020, is a prime example of a company taking a calculated risk on Bitcoin. Their investment, as reported by Cointelegraph, underscores their conviction in Bitcoin as a value store over the long term. Michael Saylor, CEO of Microstrategy reports the performance of their balance sheet in bitcoin (+124%) since 2020, vs what it would have been had they invested in the S&P (+26%), gold (-3%), silver (-19%), purchased bonds (-24%), or indeed kept a cash balance sheet, which would have lost over 25% of purchasing power in the same period.

Echoing this sentiment, Tahini’s—a Canadian Middle Eastern restaurant chain—converted its cash reserves into Bitcoin. Co-founderAli Hamam had the following to say:

“Going through the crisis of March [2020] … was tough on us and people were scared to go out and eat. My cousin, my brother and I let a significant amount of our partners (employees) go and were working day and night to keep the restaurants afloat. Our cash reserves swelled and business was booming again. But it was apparent to us that cash didn’t have the same appeal. That eventually with all the excess cash circulating … it would be worthless,”

Their decision, as detailed in their announcement, was influenced by a desire to preserve wealth, seeing Bitcoin as “a true free savings technology.” While Tahini’s & Microstrategy are examples of businesses who converted close to 100% of their balance sheets to Bitcoin, they did so having thoroughly researched and understood Bitcoin and macro economic environment. For businesses considering saving Bitcoin, it is advisable to start with a conservative allocation, perhaps 5% to 10% of their balance sheet. This allows participation in long term upside while managing the short-term downside risks.

The Final Word

All of this might seem like quite a bit of effort, but like many things, we learn best by doing and it really isn’t that difficult. Try it out. Start small. In no time, you will realise it is all very simple, and you will almost certainly get a sense of achievement and reassurance that you are now part of a fully self-sovereign monetary network. With significant uncertainty in the banking sector and the use of physical cash, this is one step you can easily take towards future-proofing your business.

If you have questions or require some support, then don’t hesitate to get in touch with us here at Bitcoin Network Ireland. We are all well versed on Bitcoin and have created this company so that we can offer our knowledge to you free of charge.