The average worker in Ireland must earn €10,000 in additional income just to maintain the same standard of living they enjoyed in 2022. This is according to valuable research conducted by Conor Pope in 2023. Not only have housing costs increased, but also the annual cost of groceries, which has risen by almost 17%, adding roughly €1,200 to the average grocery bill. Additionally, domestic energy bills have doubled, with many households spending over €2,000 more on utilities. Homeowners with mortgages face even greater challenges, with annual mortgage bills increasing by around €5,000.

Whilst the research is alarming, we thought it a useful exercise to determine how many working hours of income have been stolen from the average worker in Ireland. If Pope’s findings are correct, then that figure comes to a staggering 34.5 hours per month.

Breaking Down the Numbers

The average salary in Ireland is €45,000, which equates to roughly €21.63 per hour for a standard 40-hour work week. To compensate for the €10,000 loss incurred over the past year, an average worker would need to work an additional 411 hours annually, or about 34.5 hours each month.

Calculating Actual Working Hours

Considering holidays, the actual working hours in a year are less than the theoretical maximum. Full-time employees in Ireland typically have 20 days of paid annual leave and 9 public holidays, totaling 29 days off. This equates to 5.8 weeks (29 days / 5 days per week), leading to 46.2 actual working weeks per year (52 weeks – 5.8 weeks). Therefore, the total working hours in a year amount to 1,848 hours (46.2 weeks × 40 hours/week).

Revised Hourly Wage and Extra Hours Needed

The revised hourly wage is approximately €24.35 (€45,000 / 1,848 hours). To make up for the €10,000 loss, an employee would need to work around 411 extra hours, or approximately 34.25 hours per month.

Inflation, a monetary phenomenon

Milton Friedman’s renowned assertion, “Inflation is always and everywhere a monetary phenomenon,” highlights the central role of institutions like the ECB in the contemporary process of money creation. Unlike historical monetary systems based on tangible commodities with inherent, unforgeable costs, today’s economies use fiat money, which relies on trust in the issuing authority — trust, that is, to not to inflate the supply. These loose bonds grant governments and central banks an extraordinary privilege, shared only by criminal counterfeiters.

Discussing the root cause of the inflation we are experiencing today, respected analyst Lyn Alden offers insightful observations:

“From 2020 through 2021, the combination of fiscal and monetary stimulus (along with supply chain disruptions) in response to the pandemic lockdowns caused a surge in most asset prices and then a surge in consumer prices.”

Alden aptly highlights supply chain disruptions, acknowledging their temporary impact on prices, which typically resolve naturally over time. Should you want to learn more about inflation, Lyn has written a comprehensive guide on the topic.

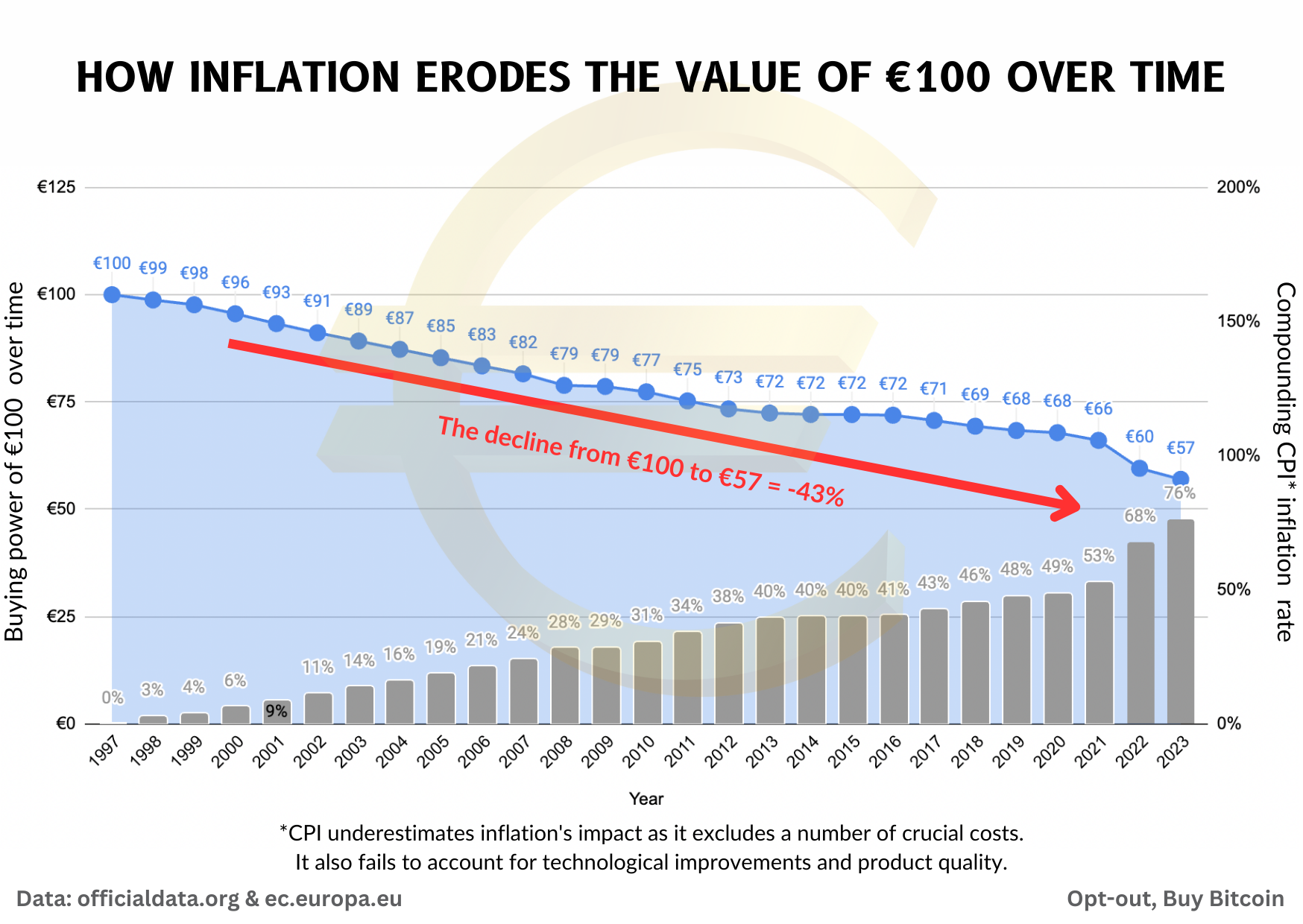

Inflation operates as an ‘invisible thief,’ eroding the value of people’s earnings and exerting a corrosive influence on society. It resembles a slow poison that gradually undermines the economic health and well-being of citizens. Despite its invisibility, the effects are conspicuous, particularly in the perpetual need for more currency units to acquire goods and services.

The Hidden Process of Currency Debasement

One of the significant achievements of modern states is their ability to conceal the debasement of their currency. In historical times, rulers debased physical money by reducing its precious metal content. Today, however, modern technology and sophisticated accounting methods have obscured this process from public view. Those who dare to challenge or expose these practices are often marginalised or ignored, perpetuating a cycle of currency manipulation that goes largely unchecked.

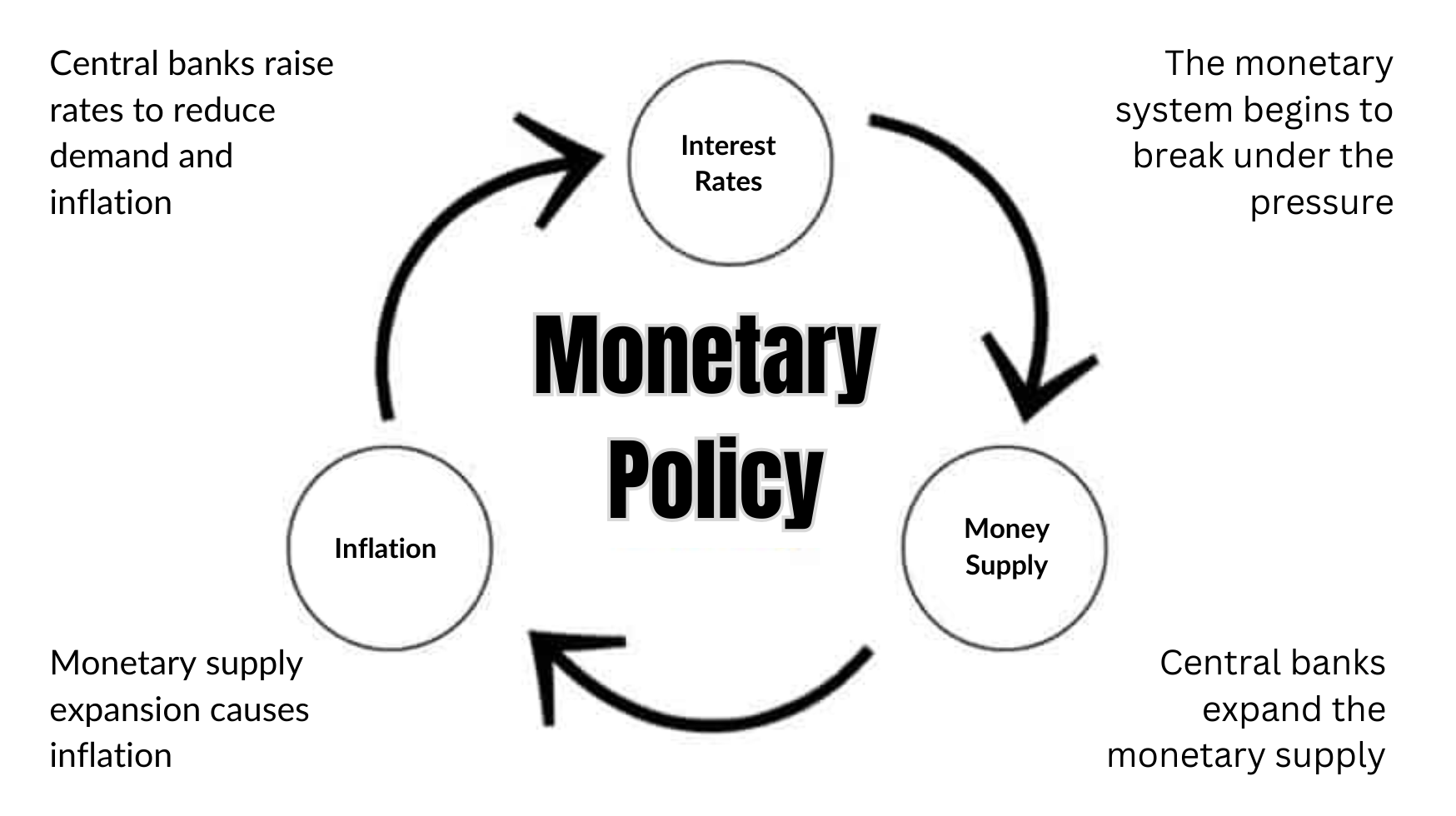

Central bankers like to employ colourful new terms to explain the mechanisms behind their operations, however the underlying process rarely changes. It’s a simple equation really, expanding the money supply causes inflation, and to reduce inflation they seek to reduce employment in an effort to kill demand. They do this by raising rates, which inturn creates economic stresses, which are relieved by the expansion of the monetary supply, which causes inflation.

The net result of all this easy money is to have a currency that’s increasingly losing value, savings that are unable to outpace inflation and homes that are no longer affordable.

It wasn’t always like this

The gold standard, a monetary system thousands of years in the making, operated in stark contrast to the pernicious debasement of fiat currencies. England adopted a de facto gold standard in 1717, formalised in 1819. The classical gold standard spanned the years 1871 to 1914 and was affectionately known in Europe as La Belle Époque. This was a period of unprecedented economic growth with relatively free trade in goods, labour, and capital. With inflation rates remarkably low at less than 0.1%, it demonstrated the potential for a monetary system anchored by a tangible, finite resource which would not cause inflation.

This brief moment of stability was ultimately disbanded during the interwar period as governments scrambled to access more money – at any cost. Gold’s centralization forces were accelerated by executive Order 6102 and various other methods of confiscation from various governments, which further consolidated gold under state stewardship. The consequences were significant, as it allowed governments to exert unbelievable control over the monetary system, which led to the prioritisation of selfish political goals at the behest of economic and social stability.

To this day, we continue to experience the ramifications of gold’s weak underbelly. Its inevitable demise marked the end of an era and the beginning of a search for a more resilient and decentralised monetary system.

The decentralised solution

A decentralised monetary system is essential for re-establishing the separation of money from the state. This separation is crucial for eliminating intermediaries such as banks and governments from financial transactions, thereby enhancing financial privacy and security. Additionally, it streamlines international transactions and reduces the risk of currency manipulation, promoting a more innovative and equitable economic environment.

Bitcoin stands out as the foremost – if not the only solution to the issue of currency debasement. Operating on a decentralised network, Bitcoin is fundamentally different from fiat currencies – and cryptocurrencies. It has a furiously defended finite supply capped at 21 million coins, each divisible into 100 million Satoshis, ensuring a limited total circulation.

Bitcoin’s fixed supply resembles the limited availability of gold under the gold standard, serving as a strong defence against the inflationary nature of today’s economy. While the gold standard maintained an exceptionally low inflation rate of 0.01% in the late 19th century, a Bitcoin standard would impose deflationary pressure on the economy, which, contrary to the views of keynesian economists & government officials, would offer extraordinary benefits to society. By allowing the productivity gains of technology flow to society, purchasing power would increase by approximately 5% annually, assuming the continuation of the current 5% yearly technological deflationary trend. Free from central bank control and bolstered by a transparent and immutable ledger, Bitcoin is a modern tool for value preservation, digital salability and permissionless transactions. You can read more about the relationship between technology and deflation in Jeff Booths book, “The Price of Tomorrow.”

Bitcoin represents not just a financial innovation but a potential shift towards a more equitable economic system. It offers a chance to restore fairness in society and possibly usher in a new era of prosperity and stability, reminiscent of La Belle Époque. To delve deeper into this topic and understand why Bitcoin should be taken seriously, we invite you to give it some serious thought. We believe Bitcoin presents an unparalleled opportunity in our lifetime to realign our financial systems towards greater fairness and stability.