Bitcoin’s Imminent ‘Halving’ is Monetary History in the Making

In the early hours of Saturday 20 April 2024, Bitcoin will undergo its fourth ‘halving’ event. This is a predetermined change to Bitcoin’s monetary policy, whereby the number of new Bitcoin issued each day is cut in half. To mark the occasion, small and disparate groups of people all over the world will gather and count down to the moment in a way one might associate with the arrival of a new year. While this may resemble a niche and quirky affair of little consequence, the passage of time could assign it a far greater weight.

What is the Halving?

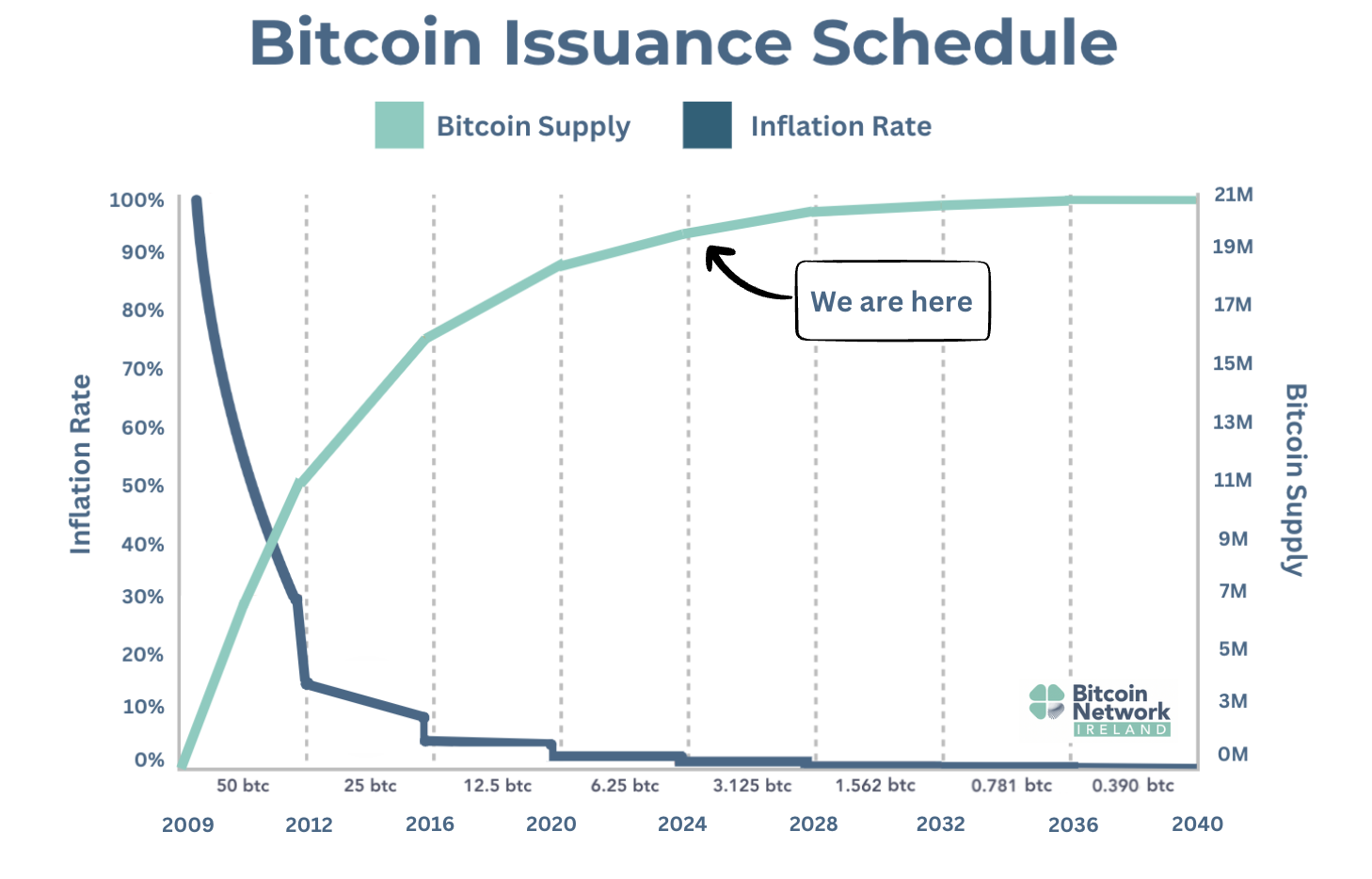

Since its inception in 2009, Bitcoin has maintained a pre-programmed supply schedule that can be verified by anybody running the code. The basic terms of this schedule are quite simple. Every time transactions are recorded, new Bitcoin is issued to incentivise the mining process, which is a core component of the network’s security. Every four years approximately, the number of new Bitcoin issued is cut in half. This four year cycle repeats until the issuance of new coins reaches zero and the total supply approaches a maximum of 21 million, projected to occur sometime around the year 2140. Unlike that of other currencies, the supply of Bitcoin is entirely transparent, fixed and predictable into the future.

While the act of reaching and maintaining global consensus on the state of a distributed ledger is impressive in itself, this particular halving is somewhat special among the many that will take place. When it occurs, the number of Bitcoin issued every day will reduce from an average of 900 to 450, and at that point, over 19.68 million out of the limit of 21 million Bitcoin will be in circulation. The annual issuance relative to the total circulating supply will fall from approximately 1.7% to 0.85%. For comparison, gold’s monetary inflation rate in 2023 was approximately 1.7%, and usually falls somewhere between 1% and 2%, depending on what is mined in a given year. As such, on this date, Bitcoin will become the world’s scarcest globally accessible financial asset, making it the ‘hardest’ money in history.

Fools’ Gold

The potential implications of a decentralised, digitally-native currency surpassing gold’s scarcity can best be appreciated through an understanding of the role gold played in the global economy over centuries as the premier monetary asset. It overshadowed silver and other precious metals in large part because its supply was more difficult to inflate, and so it became the universally recognised way of storing and transferring value, both within and between economies.

While gold’s physical limitations made its use impractical for modern commerce, necessitating the substitution of centrally-issued paper currencies, Bitcoin comes without the strings of physical storage and transport attached. It is also far easier to verify and divide, winning on any first-principles analysis of what makes good money. While Bitcoin may lack gold’s millennia-spanning track record, 20 April 2024 will likely be marked in future history and economics textbooks as one of the symbolic milestones along humanity’s transition from an analogue system of value accounting to a digital one.

Many people have a near-instinctive aversion to contemplating the prospect that something like Bitcoin, which remains rife with speculation and volatility, could ever play any significant role in the global financial system, let alone constitute its next base. The fact of the matter is that the record of the economists and central bankers who have consistently opined that Bitcoin is merely a passing fad and a modern-day tulip mania scores poorly. They have been proven fundamentally wrong by the market time and again, some for more than a decade. There must come a time when they query what it is about their conceptions of this phenomenon that doesn’t accord with reality.

If Bitcoin does represent the tectonic monetary shift that many of its proponents claim, history demonstrates that such a change can happen fast and is worth deliberate anticipation. It is clear that the Euro is not a viable way of storing value over the long term, and the widespread use of property as a surrogate to do so has contributed to the dysfunctional housing market which is now taking a toll on social cohesion by pitting the financial interests of different demographics in our society against each other.

Winds of Change

There is a burgeoning realisation that a form of sound money immune from debasement could be a step towards addressing some of these issues. To conceive of Bitcoin’s potential to fulfil this function requires a recognition that a mere 15 years ago it was unknown software run on a single computer. On every measure, it is closer to resembling good money now than it was then, with little evidence that it is done yet. It is difficult to envisage how a decentralised monetary system could incubate from scratch in any manner other than the one so far witnessed.

Since the previous halving in 2020, publicly traded companies and nation states like El Salvador have officially adopted it as a balance sheet asset. The world’s largest asset managers, unwilling to touch it then, have recently launched Bitcoin exchange-traded funds in the US which have seen some of the most aggressive inflows of all times. Just this week, the approval of equivalent Hong Kong funds represents Asia’s entry to the institutional fray. The general trend is difficult to credibly deny, as valiantly as some sceptics may try.

The financial system is undoubtedly undergoing a period of flux. The current geopolitical balance, underpinned by the US dollar as the world’s de facto reserve currency, is beginning to look fragile. At the same time as the US national debt is becoming grossly unsustainable in the midst of significant and sustained budget deficits, rivals are realising, following the Russian invasion of Ukraine, that having a global financial system controlled by the West is an unpalatable strategic vulnerability. Holding US and European debt as a reserve asset is not as attractive as it once was, and countries outside the Anglosphere are endeavouring to find viable alternatives, albeit with little success as yet. Central banks the world over, including our own, have been substantially increasing their gold holdings in recent years, commonly understood as a hedge against perceived periods of financial instability and uncertainty.

It is difficult to contemplate the return to a scenario in which the global exchange of goods is facilitated by the slow and costly shipping of physical gold. There now exists a fully decentralised, immutable digital asset that is outside the control of any group of nations, does not constitute somebody else’s debt, and is accessible to almost everybody on the planet. It is absolutely scarce, and so can’t be printed by central banks to flood our economies with newly created money when it is politically expedient.

A fundamental rethink of the nature of money itself remains well outside the Overton window of sensible Irish political and economic discourse; however, as Bitcoin continues to grow in liquidity, driven primarily by the engine of its scarcity, there is a logical case to be made that it will increasingly be used to underpin global trade in a fragmented world. Ultimately, the existence of a form of neutral global money should prove to be a powerful unifying force. This week’s halving is one fascinating milestone along this potential path, and is a spectacle to behold.