Examining the bias evident in this European institution’s narrative on decentralised digital money.

Introduction

The European Central Bank (ECB) is the entity charged on behalf of more than three hundred and forty million citizens of 20 European countries with stewarding financial stability and setting monetary policy, controlling the second largest currency in the world after the United States’ dollar. The degree to which this particular institution impacts the lives of Europeans, including those in Ireland, cannot be overstated. It is therefore imperative that when it, or those representing it, opine on topics considered to be within its remit, that this is done with balance, objectivity and intellectual honesty. Falling short of this is deleterious to the trust and integrity of the institution itself.

It is our considered view that the ECB is not adhering to these standards in its demonstrated approach and stance towards Bitcoin. While these shortcomings are evident across much of the ECB’s previous communications, they have been exhibited clearly in a recent speech by Fabio Panetta, Member of the Executive Board of the ECB, made on the 23rd of June 2023 at a conference organised by the Bank of International Settlements (the “Speech”). The text of the Speech can be found on the ECB’s blog here.

Most topics that are the subject of regular debate are sufficiently complex so as to elude straightforward or binary answers. Facts and data require context to parse; that context requires perspective which is itself coloured by experience, and it is rare that two individuals have had precisely the same experience. All that to say, the purpose of this response isn’t to demonstrate that our evidently positive stance towards Bitcoin is necessarily correct, but rather to make the case, by using the Speech as an example, that the ECB’s espoused position is not built upon any rigorous logic and is evidently coloured by a significant degree of intellectual bias that merits critical attention.

Many of the criticisms levelled by Mr. Panetta have been refuted in detail elsewhere. Declaring Bitcoin to be ‘unbacked’, ‘volatile’, ‘energy-intensive’ and ‘speculative’ are not novel insights, so addressing these imprecise accusations will not be the primary focus of this response. Rather, we wish to explore the fundamental logical error which runs like a thread through the Speech. This refers to the ECB’s proclivity to unjustifiably smear Bitcoin by conflating it with other cryptocurrencies without making any suitable distinctions or providing an appropriate degree of nuance.

Bitcoin and ‘Crypto’

While Bitcoin is quite obviously a cryptocurrency and the first of its kind, it is ironic that many within the Bitcoin community are among the most vocal critics of ‘crypto’ more generally, often for reasons similar to those outlined by Mr. Panetta. The second line of the Speech, having mentioned the creation of Bitcoin 15 years ago, states: “[s]ince then, crypto has relied on constantly creating new narratives to attract new investors, revealing incompatible views of what crypto-assets are or ought to be.”

The a priori assumption in Mr. Panetta’s approach appears to be that it is intellectually sound to treat all crypto ‘assets’ homogeneously and without any need for internal distinction. This is the error that, in our view, cascades any further attempted deductions into a deluge of incoherence. By way of example, to speak about Bitcoin and FTT – the crypto ‘token’ that was printed out of thin air by the failed and scandalised cryptocurrency exchange FTX – as if they represent precisely the same phenomenon does not stand up to any degree of intellectual interrogation. To be clear, Mr. Panetta does not specifically mention FTT; however, his omission of specifics is precisely the thing with which we take issue.

Mr. Panetta might better appreciate the need for nuance if the cryptocurrency exchanges that have blown up in spectacular fashion had described themselves as banks (which they couldn’t do for regulatory reasons), and distinguished speech-makers were taking the liberty of deriding those ‘banks’ and the ECB in the same breath as if there was no noteworthy distinction between them, despite the institutional checks and balances, history and sovereign mandate for the ECB and its functions.

To be clear, while we believe that Bitcoin is singularly unique for a combination of reasons related to its ethical inception, true decentralisation, Proof-of-Work consensus mechanism and it’s vastly superior network effects, we don’t wish to repeat the very mistake we criticise by suggesting that there is no difference between other cryptocurrencies. Without setting out the case for Bitcoin maximalism at length, which has been done elsewhere, it was the first viable cryptocurrency and was created in the midst of the Great Financial Crisis, giving it network properties and a culture that have proved extremely resilient and robust.

Bitcoin is the most decentralised ledger that exists and grows more resistant to influence over time. Importantly, its monetary policy has never changed and is unlikely to do so, meaning it can be predicted long into the future. This characteristic forms a deep-rooted part of Bitcoin’s ethos, symbolised by the number 21 million, which represents the supply cap encoded in the protocol and embedded in the culture. Bitcoin’s continued growth and adoption has happened despite the unscrupulous attempts of many involved in ‘crypto’ to enrich themselves by promoting the ‘next Bitcoin’, making fluid promises that have not come to fruition and towards which Mr. Panetta’s criticisms should be more distinctly addressed.

There are more than twenty thousand known alternative cryptocurrencies, many of which have significant financial backing from special interests, their own marketing departments, and oftentimes celebrity endorsement. Despite this, and notwithstanding almost 15 years of tired narratives about Bitcoin being obsolete, Bitcoin claims more than half of the market capitalisation of the entire cryptocurrency market, meaning it represents more value than everything else combined. The ECB simply cannot justify making broad and sweeping statements about Bitcoin and then using ‘crypto’ to make its case, whether it does so expressly or by implication. Such arguments are of the ultimate strawman variety.

Shifting Narratives

The Bitcoin White Paper outlined a vision for peer-to-peer cash. It was envisaged in this paper that the number of Bitcoin in existence would not surpass 21 million. Given that this was the first (and perhaps only) viable proposal for absolute scarcity in something that could function as money (also being divisible, fungible and transportable), it was always likely to substantially appreciate in value so long as it worked as intended.

Mr. Panetta criticises Bitcoin for a narrative shift in 2017 due to congestion. Implicit in this criticism is an acknowledgement of success; congestion was an issue only because of the significant demand for such a decentralised payment infrastructure. The ‘Digital Gold’ narrative did not suddenly appear in 2017; however, it is a false dichotomy to imply that a non-sentient protocol for some reason must choose whether to be more like Gold or cash. An understanding of how Bitcoin works underscores that decentralisation and security can only be meaningfully achieved when the value of the network grows and incentivises the dedication of adequate resources to protect it from attack.

Despite correctly setting out the ‘blockchain trilemma’, Mr. Panetta conveniently ignores the emergence of layered solutions on top of Bitcoin to overcome congestion issues. The most promising of these appears to be the Lightning Network, the value of which was recently explored in detail by the third largest bank in the Eurozone. Omitting any mention of this in a speech that directly criticises Bitcoin based on transaction throughput must be either disingenuous or uniformed. A Gold/cash distinction is one relevant to the analog age given inherent physical tradeoffs; Bitcoin is on track to be a digital version of both, capable of having its cake and eating it too.

In any event, given its actual decentralisation, it is of little consequence what narrative is ascribed to Bitcoin by particular individuals or groups. Nobody can exert significant influence on it or change it, much like a physical commodity. Since Bitcoin’s creation and on its current trajectory, it appears to us to be emerging as a form of decentralised digital money. This is reflected in the fact that it is already commonly used both as a store of value and a medium of exchange. With the passage of time and greater maturity, we also expect that it will more frequently serve as a unit of account.

Centralisation and Trust

Mr. Panetta states, referring to ‘unbacked cryptos’, that “they have progressively moved away from their original goal of decentralisation to increasingly rely on centralised solutions and market structures”. As mentioned, proponents of Bitcoin would agree that many of these criticisms are accurate when looking at some ‘crypto assets’, and recent failures of centralised exchanges are indicative of this; however, this is a highly selective and misleading interpretation when applied to Bitcoin for two reasons.

First, Bitcoin is one of the only financial assets that can actually be held by an individual without the need for a trusted third party, and this is a practice that is widely encouraged given the propensity of centralised financial entities, whether crypto or traditional, to rehypothecate user funds in a reckless manner. Similar to Gold, Bitcoin is a bearer asset, and provides the important option of avoiding the requirement to place trust in others. If anything, Mr. Panetta’s point actually underscores Bitcoin’s importance.

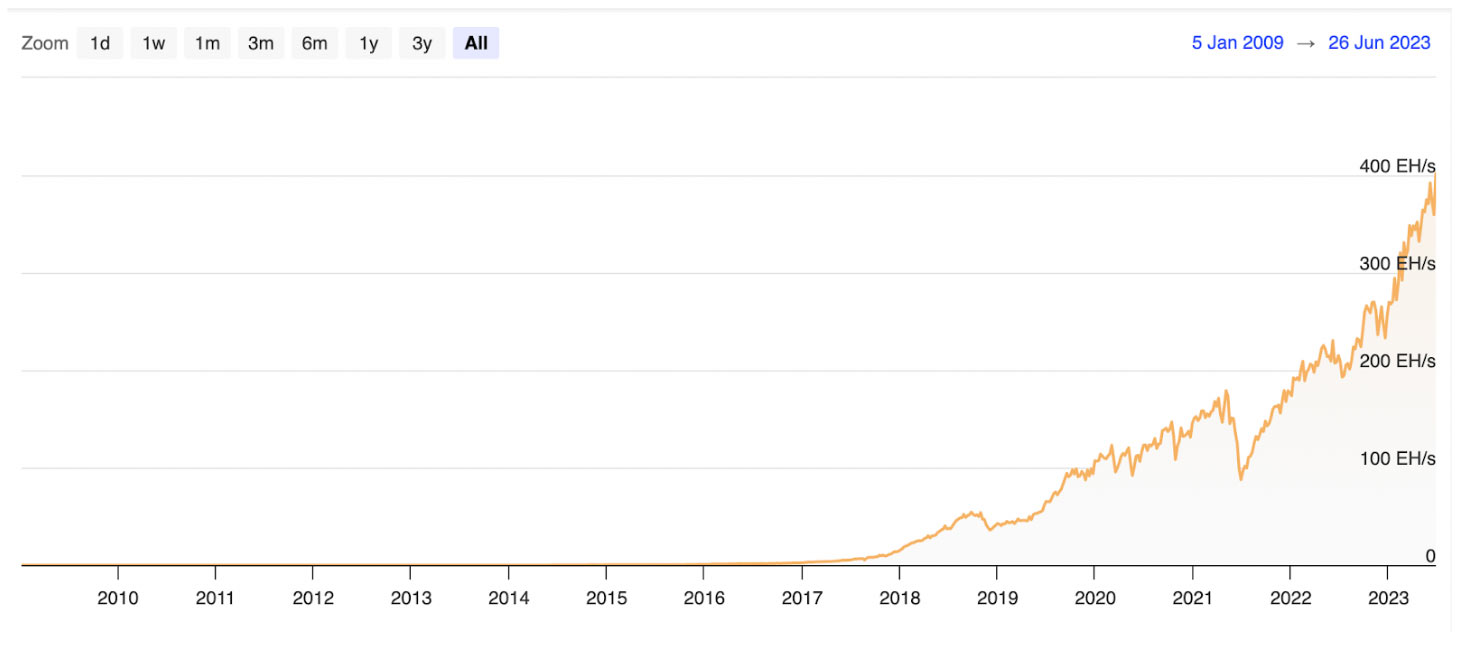

Secondly, the statement is definitionally misleading because Bitcoin has seen increasing decentralisation over time, which is measurable and represented by the amount of energy (or hashes) defending the network. The growing number of users of the network, and the increasing number of nodes verifying the state of Bitcoin’s ledger also continue to grow, even as the price may be volatile. Finally, and in direct contradiction of Mr. Panetta’s statement, the percentage of Bitcoin held on centralised exchanges currently stands at approximately 11.7%.

Bitcoin’s Hashrate continues to hit All-Time Highs, nearing 400 Exahash per Second

Other public institutions have made greater efforts to draw relevant distinctions in this area. The United States’ Securities and Exchange Commission (SEC) has recently launched significant enforcement actions against major cryptocurrency exchanges for allegedly listing unregistered securities and has delved into the specific characteristics of various crypto assets in order to determine whether they meet the definition of a security under the legal ‘Howey Test’. The current SEC Chairman has on several occasions stated that Bitcoin is not a security, and it appears to be the only crypto ‘asset’ where there is a relatively firm consensus that this is the case. The ECB should make the effort to draw such distinctions between various crypto ‘assets’ and Bitcoin rather than conflating the virtues and vices of each in a rather incoherent way.

Volatility, Bubbles and Gamblers

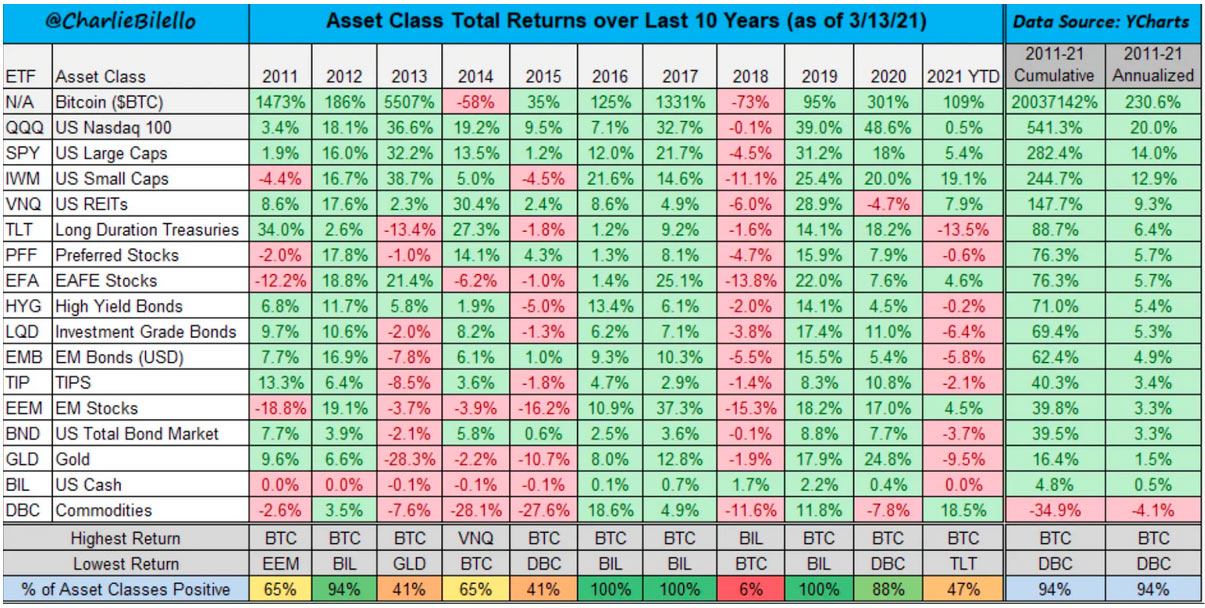

Mr. Panetta uses words such as ‘gambling’, ‘bubble’ and ‘speculative’ liberally throughout the Speech. We are not clear what gives Mr. Panetta the insight or moral authority to confidently declare those of us that wish to save the value of our time and effort in an immutable ledger that cannot be diluted as gamblers; it is deeply patronising and does not stand up to scrutiny. While speculation undoubtedly influences Bitcoin’s price, and this likely occurs to a greater extent than many of the more mature asset classes given its age, the fact that an increasing number of people choose to use it to store value is demonstrated by the fact that Bitcoin’s price in each cyclical bear market is almost always substantially higher than the previous one.

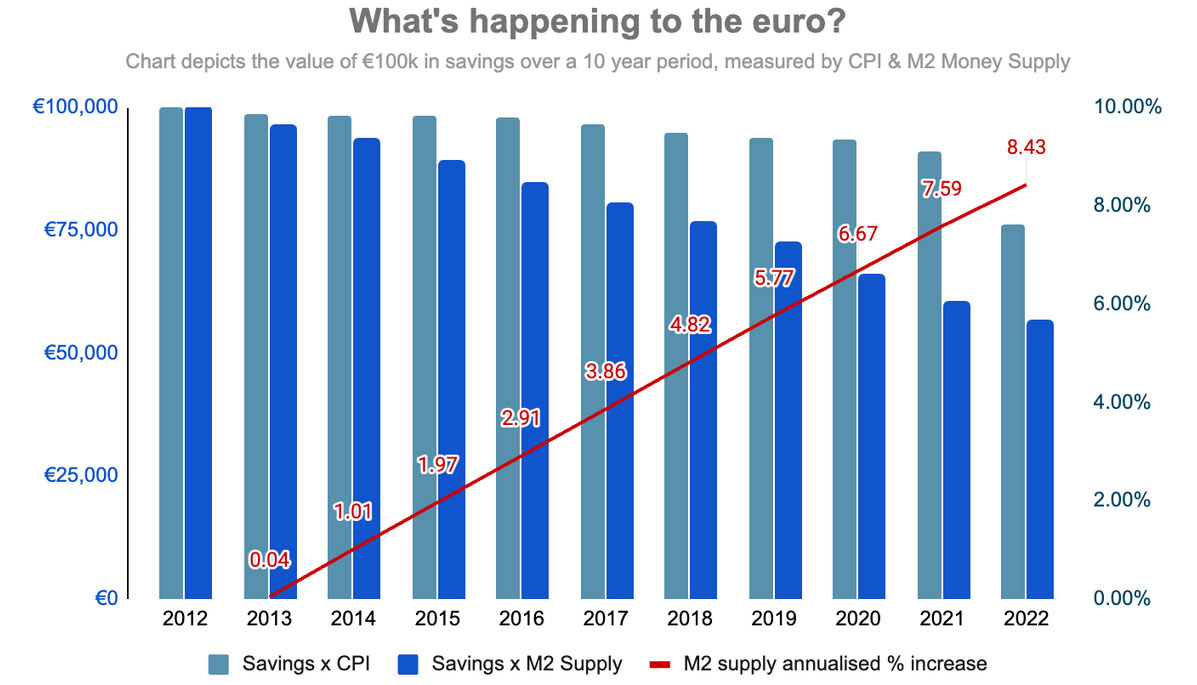

Mr. Panetta uses a number of charts to make his case, and it appears to us that those in glass houses should be slow to introduce stones to a debate. The ECB has a mandate for price stability, and states on its homepage that “[w]e do this so that you will be able to buy as much with your money tomorrow as you can today.” Notwithstanding that this statement is logically incompatible with the ECB’s stated two percent inflation target, the following chart demonstrates the loss of purchasing power of the Euro over the past decade:

That saving for the future in the Euro is unwise is beyond argument. This makes it necessary for people to use other investment strategies to preserve purchasing power over time, resulting in periodic housing bubbles, stock market bubbles, and indeed, ‘crypto’ bubbles, which are all intimately tied to prevailing credit conditions, themselves set by Central Banks. Mr. Panetta rests much of his argument on the dramatic fall in the price of Bitcoin and other cryptocurrencies since November 2021 as evidence that Bitcoin cannot be used as a store of value; however, although he demonstrates that Bitcoin is relatively more volatile than Oil, Gold and index funds, he doesn’t purport to advise you how you should store value to keep pace with the monetary inflation rate of the Euro.

Despite including a chart on Bitcoin’s returns correlation with other assets, Mr. Panetta provides no basis for selecting November 2021 as the appropriate point in time as a useful frame of reference, and omits mentioning that Bitcoin, despite volatility, has been the best performing store of value over most multi-year periods since it was created.

Finally, Mr. Panetta doesn’t dwell on the fact that Bitcoin’s monetary policy didn’t change in November 2021. Rather, that was precisely and not coincidentally when Central Banks, led by the US Federal Reserve, decided to increase interest rates dramatically after keeping them artificially low for over a decade, precipitating a fall in the value of almost all investable assets. If this doesn’t indeed transpire to be ‘Bitcoin’s Last Stand’, the ECB will surely have to take the time to understand why this phenomenon may be worth taking more seriously.

What Constitutes ‘Societal Benefit’?

The final point we will briefly address in Mr. Panetta’s speech is the important assertion evident in the statement that “[p]olicymakers should be wary of supporting an industry that has so far produced no societal benefits”. While we would generally agree that much of the ‘crypto industry’ has indeed produced no value beyond the facilitation of speculation, any implication that Bitcoin has produced no societal benefits can be forcefully refuted.

Alex Gladstein of the Human Rights Foundation has released an entire book dedicated to common misperceptions among people fortunate enough to live in developed countries related to Bitcoin which is entitled “Check your Financial Privilege”. In it, he provides numerous concrete and detailed examples of economic empowerment enabled by the existence of Bitcoin.

In a world where a significant proportion of the global population are unbanked, Bitcoin improves financial inclusion by allowing anybody with a phone and internet connection to send, receive and store value anywhere in the world in a fraction of a second for nearly no cost. More than half of people live in countries with authoritarian regimes, usually accompanied by weak property rights, poor rule of law, and rampant inflation. Bitcoin allows them to self-custody a form of money that is resistant to censorship, confiscation and inflation. It is a financial shield desperately needed by those in the least fortunate circumstances; however, the importance of such a tool is also becoming increasingly obvious in more affluent countries, as recent inflation has demonstrated.

Like any fundamentally facilitative technology, people can legitimately hold differing views on how the potential benefits and drawbacks of such enablement should be measured. This is heavily informed by context and perspective; however, to deny outright and without qualification that Bitcoin has the potential to increase individual sovereignty in a positive way constitutes an exhibition of cognitive dissonance that does not account for reality. Those that consider the matter to be cut and dry should perhaps engage with Rawls’ Veil of Ignorance before closing their minds to any potential societal benefits that may not be apparent through the lens of financial privilege available only to some.

In a final sense, and in one that may be somewhat uncomfortable for Mr. Panetta and his colleagues at the ECB, it is beginning to appear that Bitcoin can constitute an important check and balance on the expansion of Central Banks’ balance sheets globally. The Quantitative Easing that has been liberally engaged in since the Great Financial Crisis has resulted in a widening wealth gap between those that own property and other financial assets and those that don’t, which precipitates numerous other negative outcomes in addition to constituting an obvious affront to basic fairness. As well as providing a hard asset which can be owned in granular quantities by those without the means to protect their purchasing power with traditional means, Bitcoin is serving to educate multiple generations on the implications of using blunt tools of monetary policy in times of economic crisis, and such financial literacy itself inures to the benefit of society generally.

Conclusion

We understand some of the opinions expressed by Mr. Panetta, and agree that many of the issues identified by him are indeed real and deserving of attention. In our view however, there is significantly more nuance to parse, and we strongly caution against throwing the baby out by virtue of having confused it with the bathwater.

In the early years following the emergence of Bitcoin and cryptocurrencies more generally, it is not difficult to see why, applying our collective experience of broadly analogous trends, it would have appeared appropriate to discuss, analyse, criticise, and regulate them as if they were all of the same ilk. It is however becoming clearer with the passage of that time that such a mental model is deficient, and the merits of Bitcoin should not be analysed on the same page, less so the same sentence, as imitative, centralised protocols which often rely on information asymmetry, evolving narratives and regulatory lacunas to bypass securities laws and extract value from investors.

We sincerely hope that Mr. Panetta and the ECB generally will take the time to understand the importance of this distinction going forward and approach Bitcoin with a level of objectivity that European citizens deserve.