At the heart of Bitcoin’s design is its capped supply. This capped supply and the unique mechanics behind it are driving factors behind bitcoins price appreciation.

The price volatility of Bitcoin has left countless sceptics scratching their heads as bitcoin’s price continues to appreciate, despite their unfounded declarations of its demise. Bitcoin, which has been declared “dead” 474 times in the past, has consistently defied expectations. In this article, we will explore the fundamental drivers behind bitcoin’s price movements, with a focus on the impact of its programmed scarcity and how it attracts an increasingly diverse range of investors, especially in times of uncertainty.

The Mechanics of Bitcoin

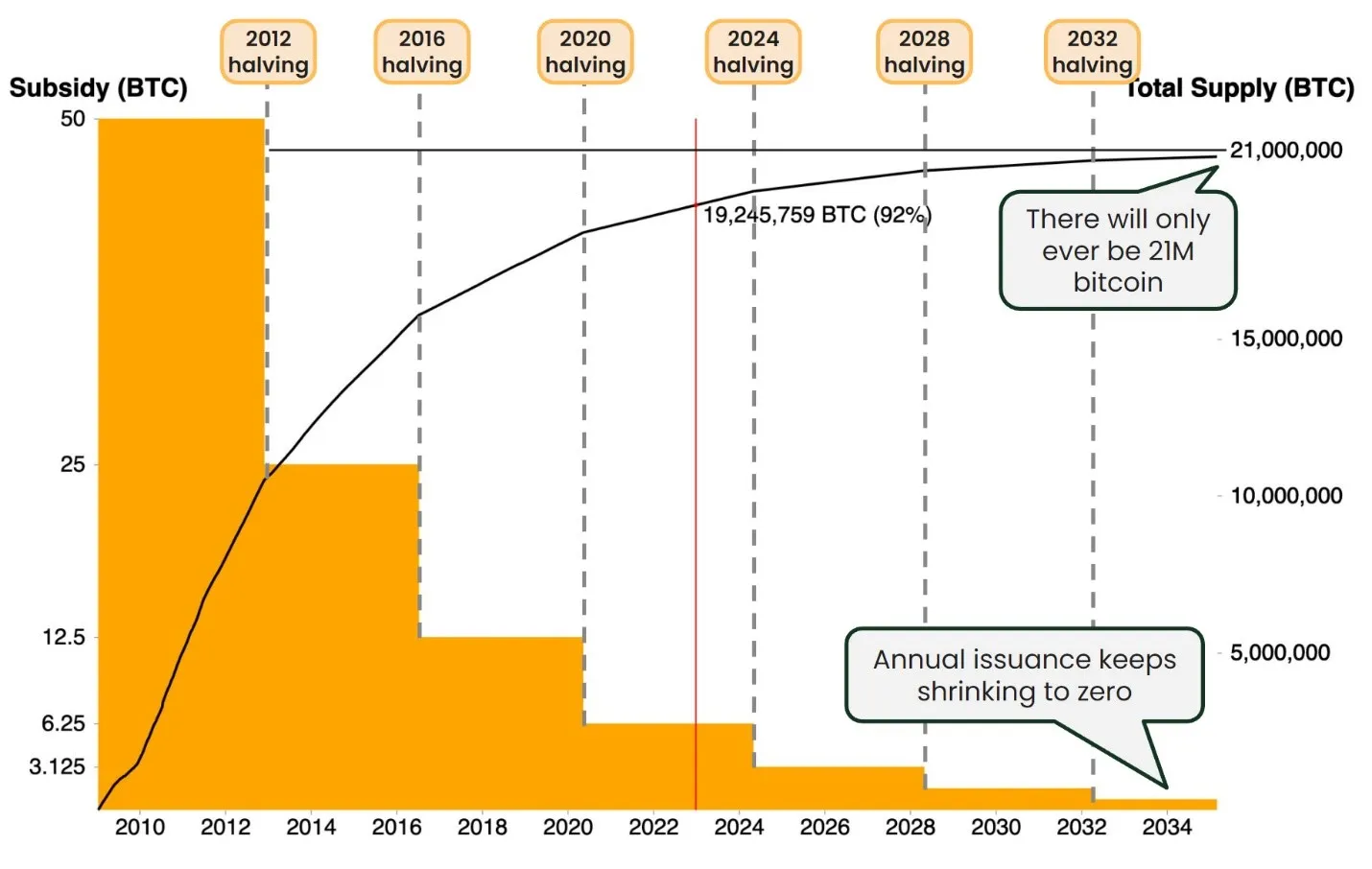

At the heart of Bitcoin’s mechanics is its capped supply. Unlike traditional currencies subject to arbitrary printing, bitcoin is strictly limited to 21 million coins, ensuring no excess can be added to the market. Through a process known as “halving,” the number of new bitcoins created daily is reduced by half every four years.

Image credit: Jesse Myers

With approximately 19.55 million of the 21 million Bitcoins already issued (93%), the scarcity factor distinguishes bitcoin from fiat currencies that can respond to economic challenges by printing more money. Further still, of the 19.55 million coins in circulation, 78% of it is considered illiquid, because those who own the asset are choosing not to sell it. This leaves just 3 to 5 million bitcoin available for sale at any time. With an estimated 60 million millionaires & 3,000 billionaires in the world, very very few will ever be able to own as much as one bitcoin.

Understanding Scarcity

Scarcity, a fundamental concept in economics, plays a pivotal role in Bitcoin’s price dynamics. It’s crucial to differentiate between two types of scarcity: relative scarcity and absolute scarcity.

- Relative Scarcity: To illustrate relative scarcity, let’s consider gold, a relatively scarce resource. If there is a sudden surge in demand for gold, its price rises. In response to higher prices, gold miners increase their efforts to extract more gold, boosting the supply. As supply catches up with demand, the price of gold tends to decline, eventually returning to its original equilibrium. The same holds true for Rolex watches, Louis Vuitton handbags and various other luxury goods. In a nutshell, relatively scarce goods don’t have a fixed supply; as when demand rises, supply can increase to meet it.

- Absolute Scarcity: The Mona Lisa is a good example of absolute scarcity. If demand for the Mona Lisa spikes, its price surges as well. However, unlike gold, Rolex watches or Louis Vuitton handbags, the supply of the Mona Lisa cannot increase because it’s impossible to create an exact replica of the painting. Leonardo Da Vinci, is long deceased, therefore no one can replicate it. Consequently, in cases of absolute scarcity, there is a finite, fixed supply, and increased demand doesn’t trigger a corresponding supply response. Supply remains inelastic, with the only variable that can change being the price.

Bitcoin’s Absolute Scarcity

Bitcoin embodies absolute scarcity, and this property underpins its value proposition. The number of bitcoins in circulation will never exceed 21 million, as per its protocol. When demand for bitcoin rises, the only variable that can adjust to maintain supply-demand equilibrium is the price. While this absolute scarcity makes bitcoin a valuable asset, it’s also a key factor contributing to its price volatility.

Unlike fiat currencies, which can be printed at will by central banks, bitcoin’s absolute scarcity ensures that its supply remains unaffected by fluctuations in demand. This unique characteristic is a defining feature that sets bitcoin apart.

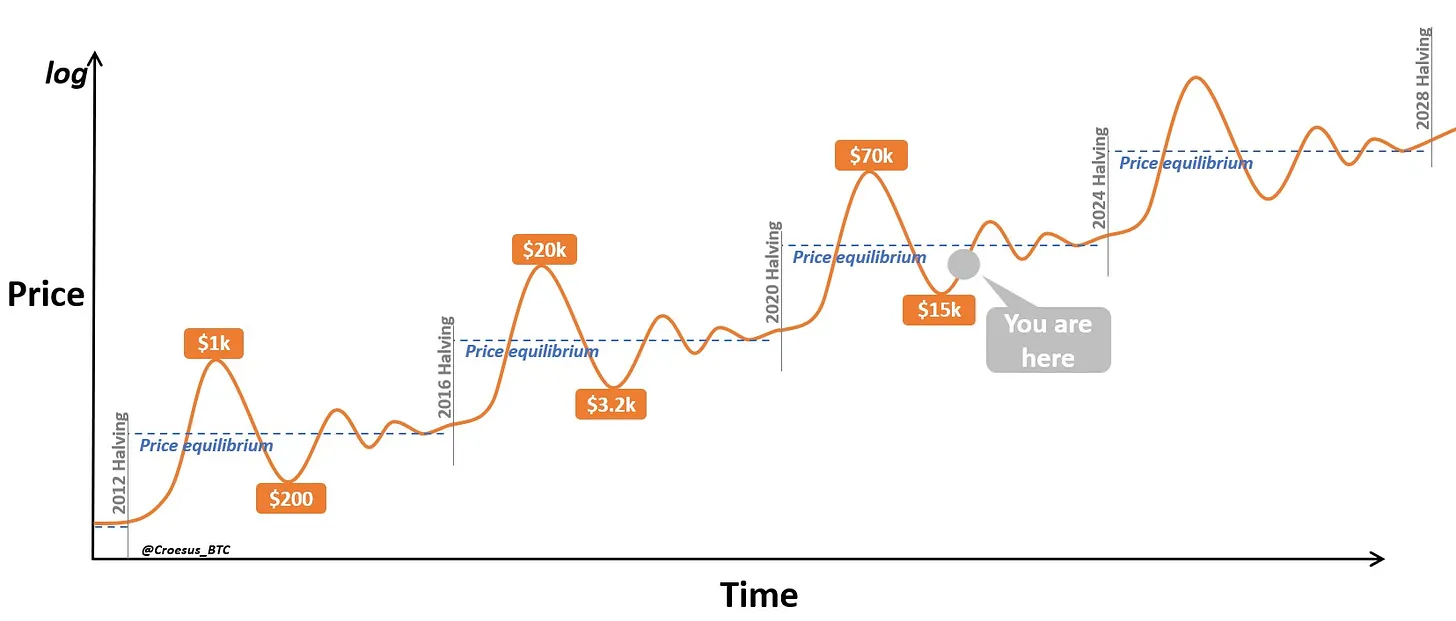

While bitcoin’s scarcity is absolute, it’s important to note that this scarcity will persistently tighten until around the year 2140 when the last bitcoin will be issued. As each halving cycle passes, bitcoin becomes scarcer, which in turn propels its price higher. This consistent trend has enticed an increasing number of investors, savers, and speculators to participate in the price appreciation. Bitcoin’s price has historically moved in 4-year waves, a reflection of the halving events, where the reduction in the rate of new coin issuance adds to the growing demand for this digital asset.

Image credit: Jesse Myers

Image credit: Jesse Myers

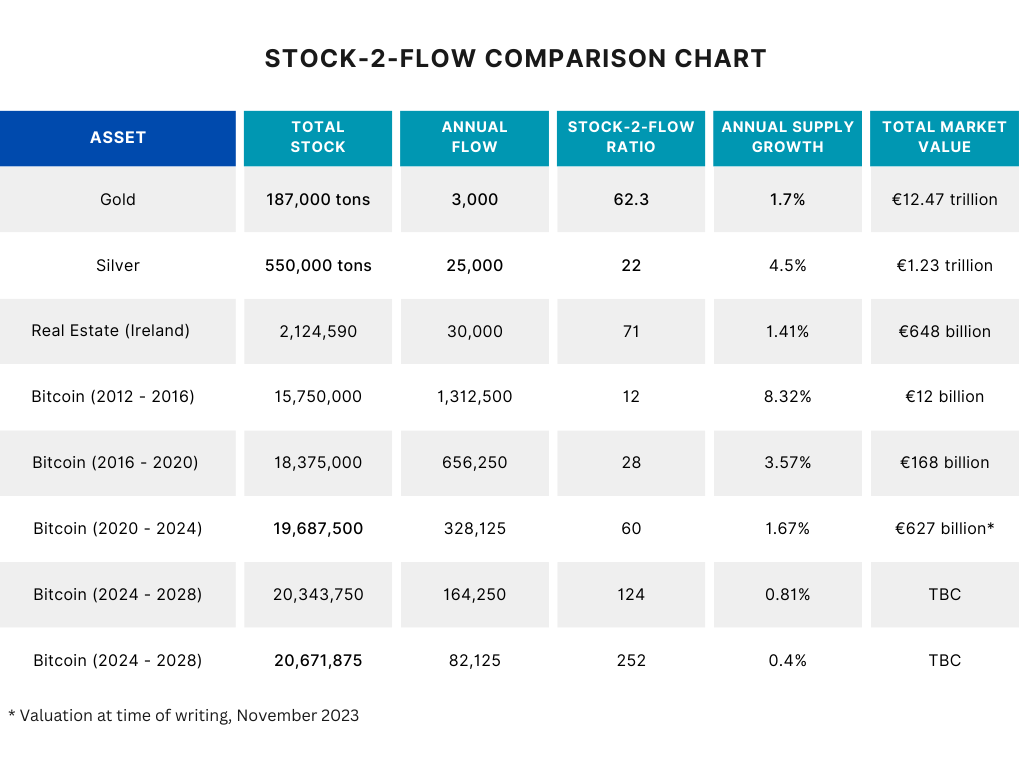

Measuring Stock-to-Flow

Stock-to-flow measures the supply side of how valuable something is by comparing how much of it exists (stock) to how much is being produced (flow). If there’s a lot of stock already and not much new stock coming, it’s considered more valuable because it’s simply harder to obtain. If there’s not much of it available and lots of new stock is being made, it’s considered less valuable because it’s easier to get.

Investors often use the stock-to-flow ratio to measure markets like real estate, gold and bitcoin. They want to know how fast new units are being created and how many are already out there. The ratio also represents the number of years it would take to increase the current supply by 100%. Therefore, the higher the ratio value, the more scarce an asset or asset class is.

For example, in Ireland there are around 2.1 million units of housing “stock”, with 30,000 new houses built last year, which is the “flow”. This gives a stock-to-flow of 71.

Stock-to-Flow Ratio = 2,124,590 / 30,000 = 71

Now, let’s draw a comparison with gold. Throughout history, an estimated 187,000 metric tonnes of gold have been mined, signifying the gold “stock.” Gold is highly durable and rarely lost, which ensures that a significant portion of this stock remains in circulation. When we examine the yearly gold production, we find that around 3,000 tonnes of gold are mined annually, as reported by the World Gold Council. This annual production constitutes the “flow” side of the model. The gold stock-to-flow ratio is determined by dividing the stock by the flow, resulting in the following equation:

Gold Stock-to-Flow Ratio = 187,000 / 3,000 = 62.3

Now, shifting our focus to Bitcoin, the total supply is capped at 21 million coins, with nearly 19.5 million already in circulation. The creation of new bitcoins occurs as miners validate transactions on the blockchain, adhering to a predetermined schedule. The final bitcoin is expected to enter circulation around the year 2140.

Currently, miners receive 6.25 bitcoins per block, with a block being mined approximately every 10 minutes. This translates to an annual flow of 328,500 BTC. Consequently, the current Bitcoin stock-to-flow ratio is as follows:

Bitcoin Stock-to-Flow Ratio = 19,530,000 / 328,500 = 59.4

Incidentally, this value is in close alignment with the 62-year stock-to-flow ratio earlier calculated for gold. This illustrates the valuable insight provided by the stock-to-flow ratio in assessing the scarcity and intrinsic value of assets.

Below is a table comparing the stock-to-flow ratios across a number of these assets.

Bitcoin’s current stock to flow is 59 and it will be 60 by the time this epoch is completed. As the issuance of new bitcoin reduces every 4 years per the protocol, its stock-to-flow will increase towards 124 from March 2024, putting upward pressure on the price once again. As its stock-to-flow increases, the grip of scarcity will become ever more apparent, leading Bitcoin to overtake the market value of silver, gold and eventually, all other asset classes.

Confidence in Immutability

Bitcoin’s immutability is firmly rooted in its robust proof-of-work (PoW) mechanism. This immutability guarantees that once data is etched onto the blockchain, it is permanent, fostering a high level of security and trust. PoW reinforces immutability by requiring miners to invest substantial computational power, rendering it exceedingly difficult and cost-prohibitive to tamper with historical blockchain data, assuring investors that their assets are safeguarded against manipulation. Whilst this is true for Bitcoin, it is not true for any other crypto asset.

The strength of Bitcoin’s immutability lies in a delicate balance among its key stakeholders – node operators, miners, and developers. This trinity ensures that no single group holds dominion over the network, a fundamental requirement for preserving the cryptocurrency’s integrity. Developers contribute to Bitcoin’s growth, but their primary rule is to “do no harm.” Miners, who invest significant resources in network security, will only accept changes if incentivized to do so. Node operators, in turn, act as the network’s custodians, validating and enforcing rules. Agreement among all three is vital for protocol adjustments, a complex consensus mechanism that safeguards Bitcoin’s unchanging nature, further bolstering the confidence of professional investors.

Lastly, the Lindy Effect, which suggests that the longer a technology persists, the more likely it is to continue to exist in the future, Bitcoin’s 14-year history stands as proof of its resilience. Investors, particularly professional investors, are growing in confidence in Bitcoin’s ability to endure the tests of time and market fluctuations. The amalgamation of immutability, PoW security, and the Lindy Effect not only establishes Bitcoin as a secure haven asset but also provides investors with a profound sense of assurance, encouraging greater participation, price appreciation and a continuation of the established trend.

To conclude, Bitcoin’s enduring resilience can be attributed to its capped supply, absolute scarcity, transparent monetary policy, immutability and unique characteristics. As Bitcoin’s supply continues to dwindle and its scarcity intensifies, investors and observers can expect the interplay of supply and demand and scarcity to continue shaping its price dynamics.